Don’t tell me that portfolio window dressing didn’t happen last week. It was the end of the month and the quarter and despite what money managers may think the market does on a going forward basis, they all had to do what all the other cool kids did last quarter, and that was to own stocks.

By way of example, look at $BIIB. The stock ran twenty points off the lows last week, but got hot starting Wednesday morning. If you go back to the beginning of this second quarter, the stocks low was about 184. If your a manager, you had to show you were long, especially if you were a PM at a healthcare fund.

On the other side of the equation, you had to get the losers off your books at all costs, and maybe for good. Look at what the coal stocks did last week. See $BTU, $CNX, $WLT etc.

Gold ($GLD) was taken to the woodshed again, but caught its first uptick since the Age of Pericles on Friday. Gold broke 1200 last week and actually broke through production cost levels. How do you like me now? Chatter that William Devane will be doing Sham Wow ads next month, maybe reverse mortgages.

It’s a tough call here. Was last week just a case of window dressing and some last minute portfolio chasing? I can easily make that case. Growth sucks, rates are rising and the summer doldrums may just want to kick in. The U.S Dollar is rising, which is a long term good thing in my opinion, but is usually a short term market negative.

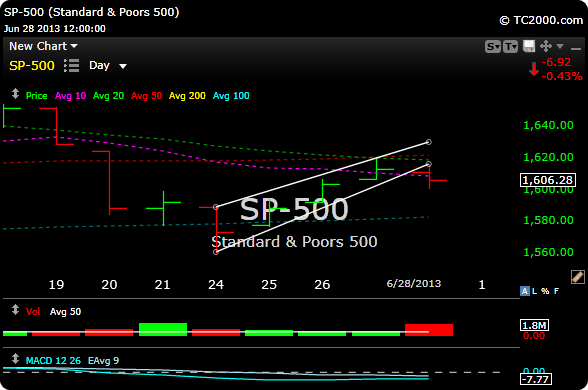

Are we just looking at a one week wonder for the $SPX and the other indices? You can argue that. Last week looks like a bear flag to me. Also, if you look at the daily chart, with the exception of the close on June 16, the S&P hasn’t had a close above its 20 day moving average since May 30.

Considering the move the market has had, that’s OK. It needed to breath, and a consolidation like this is very healthy. We are getting repriced and readjusted, mostly due to Bernanke. Again, that’s normal.

For my money though, I want see the $SPX close back above that 20 and 50 day moving average, both of which are separated by about three handles right now. Then I think the party can start again.

In the meantime, we’re back to a traders market again (which is also a good thing). This takes some of the bull market genius aspect out of the equation and requires a little more skill. Catch and release, buy ’em and sell ’em. Know your charts and know your levels. You’re guessing otherwise. Don’t get married and DO NOT be afraid to change your mind if an entry doesn’t work.

Have a great weekend. I’m still quite bullish for the second half.

Subscriptions here

Performance request here