“I don’t want to go from wild turkey to cold turkey”- Richard Fisher, president of the Federal Reserve Bank of Dallas

The $SPX made more closing highs last week as the Gilded Age for stocks continues. Next week we have Fed governors galore, so watch for any subtly telegraphed hawkishness on that front. The Fed wont upset the apple cart with strong language on a policy change, and has admitted that any pending change would be gently delivered to the markets. You never know though, how the market will react and we are at highs, so if you catch the market in a bad mood, it could be a catalyst for a slight pullback. So keep that in mind next week.

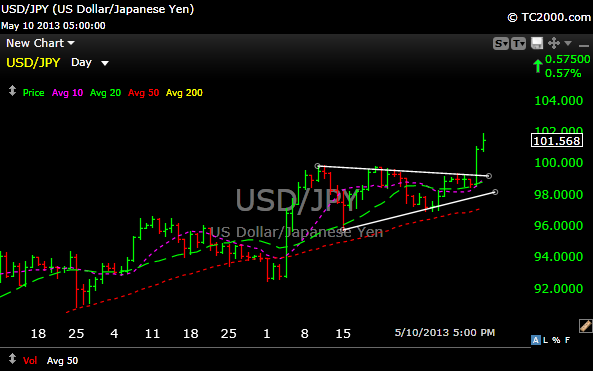

The big news last week though was Japan. The Dollar/Yen ($USDJPY) broke through par as the Yen started to get crushed to pixie dust. Get on this train because this move has at least a year left in it. As you know, long $DXJ and $YCS are my favorite plays in this space and continue to be. Again, not a trade, but a core position going forward. Bank of Japan governor Kuroda is having too much fun right now and he loves the sound of printing and buying stuff. I can just see the texts between Bernanke and Kuroda as they giggle like little kids. I’m so bullish on global printing, not global growth because there isn’t much of the latter. There is a difference. Don’t kid yourself into thinking that markets are moving higher on organic growth. The G-20 loves this move by Japan and was high-fiving them with praise all of last week. This trade has juice. This is the only reason dips keep getting bought in this tape.

There are incredible things happening to this market right now (not the economy, but the market).

If you find yourself struggling in this market, or just want to broaden your reach on some things, come by for a free trial.

Have a great weekend.

BOOM!!!!!!!!!!!!!!