The market lost some ground last week, but the uptrend is still in perfect shape. The $SPX held its 50 day moving average, the $QQQ held its 200 day moving average. The Russell 2000 is kind of in no mans land right now, and the Dow Jones never tagged its 50 day support.

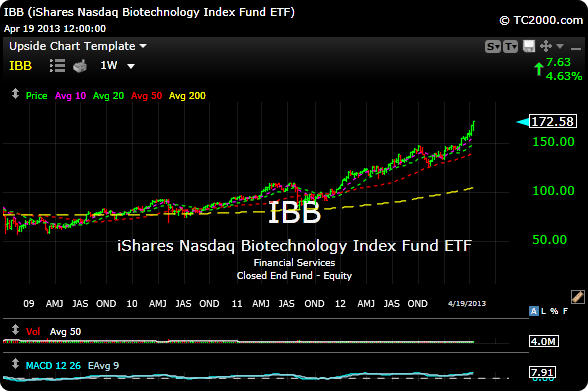

The storyline of the week was biotech as the group just keeps ripping. The Biotech etf $IBB exploded and broke out Friday on huge volume after what has been a mega run. We’ll see if Fridays action was a blow off top or not. Time will tell. Hope not, I own some of these smaller biotechs that seem to go up 5-10% a day. Most are probably garbage, but momentum is momentum. $VRTX exploded like a million points on Friday.

Technology is still very iffy here as $AAPL had the glide pattern of an anvil last week. Their earnings are Tuesday. Is a crappy number baked in yet? I say no. I’d like to see it tag its 200 day weekly moving average (372) before I throw a penny at it for a long side trade. And I just mean a trade, the stock is cooked. They better get innovating again because the “lighter and thinner” mission statement ain’t cutting it.

$GOOG had an OK number and they closed out right at the number, 800 on Friday.

Commodities went to the wood chipper as gold and silver saw a trap door. Crude got wrecked and that will be a big benefit to the economy if it can stay down. Copper approached bear market territory on Friday.

Stocks that you probably need to continue to avoid for now, at least until the rotation goes back to them, are stocks like $BHP, $FCX, $WLT, $RIO, $CLF, $JOY and $VALE. Falling knives for now.

So what is the catalyst for higher stocks prices? We are gong higher in my opinion. There is NO INFLATION and there are no real jobs. Just look at the TIPS market. We all know that “re-inflating inflation” is what all the cool kids are doing around the globe, so expect QE to go on until you are old and gray. The Fed’s Bullard as much as said so last week. The Fed has targets for both (jobs and inflation), and we are not there yet, hence easing and more QE. So booyah for stocks and buy the dips. If you fight this dynamic, you are probably doing so at your own peril.

Most bull markets defy logic and stay overbought anyway, it’s just the way it goes.

Last week and this month has been great for my subscriber site both long and short. Here are some trades that we put on the board:

$SRPT +35%, $VRTX +51%, $ASTX +35%, $NXST +35%, $DDD +15%…..SHORT IDEAS, $HES +7.0%, $ATI +6%, $CCJ +5.9%

Free trial here. To request open and closed trades go here.

Book of the week: Technical Analysis of Stock Trends …still a classic for technical analysis

Have a great weekend.