$AAPL will report earnings on April 23 after the close. The company has been falling short on earnings day recently and because of that, the stock has been punished.

At this point the bulls are hanging their hopes on two things, a possible return of capital to shareholders via some sort of dividend increase and an over telegraphed deal with China mobile later in the year.

The stock is getting sold, obviously, (Fidelity just sold 10% of their holdings in the first quarter), and it seems to be lodged in that outer body state where the growth guys are leaving in droves, but the value guys don’t think that ts cheap enough yet.

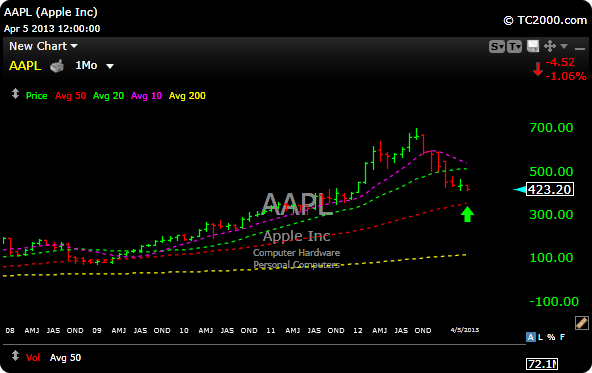

So when things get this screwy I look at the chart. I will show a weekly and a monthly view of $AAPL below.

The 419-420 level was huge for AAPL and it held that level on Friday. The stock tagged 419 on March 8, bounced, and then managed a rally to a high of about 470 a couple of weeks ago. Nice trade if you bought the level. The stock broke 420 on a intraday basis this Friday and missed tagging that March 8 low by about .60 cents. But it did hold support.

So will AAPL rally into earnings in a few weeks (why would it?) OR will it breakdown, flush out, and start a new base? If the latter happens, here are your targets

The weekly chart shows the stock right on support. A breakdown here, could start a drop to the 200 day simple moving average which is down around 370.

The monthly chart of AAPL, (also on support), shows the 50 day simple moving average down around 359.

It’s not insane to think $AAPL can trade in the 300’s. Do I think $AAPL has jumped the shark? Yes. Do I think it will be great trading stock? Definitely. Good luck this week.