{+++} The S&P 500 ended today’s session with a gain of 0.6% despite enduring some early weakness. The benchmark average started the day on a positive note with upbeat economic data proving insufficient in staving off the early selling pressure. However, markets staged a rebound in afternoon trade with the key indices climbing to fresh highs.

Home Depot (HD) had a big day after a good earnings report and that one stock accounted for about half of the DOW strength for most of the day until near the end when other stocks contributed to the gains. The S&P bottomed around lunchtime and then put on a slow steady grind higher after Bernanke was finished with the microphone.

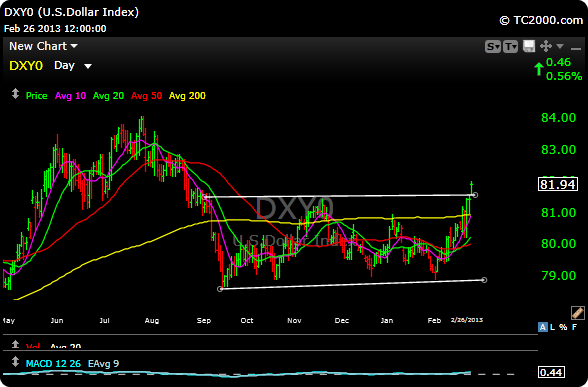

Its a good idea to watch the Dollar here as it is at the top of a range. As you know the Euro has been weak lately because of renewed problems. It will be interesting to see if the dollar fails here at the top of its trading range. If so, I think it will pave the way for a rally in both the euro and the market. As you can see in the chart below, the dollar did manage a breakout of that range. The question now is whether it topped and is ready to come back down. It printed a “doji” on today’s bar and that could imply a change of direction (meaning lower), but that may take a day or to to technically work things out. Lower dollar higher stock market. We’ll see soon enough.

I don’t have any new setups tonight. I will see you on the chat room in the morning.