Not a bullish day by any stretch as the indices rallied only roll over with some conviction. I mentioned in Saturdays post to watch out for a possible mini bull trap, as what might happen is a rally to the underside of the $SPX uptrend line and a failure. Well that’s exactly what happened today. Here is the Saturday post, see the first chart of $SPX to see what I talked about.

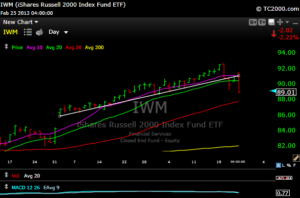

Anyway, what we need to watch tomorrow is the 50 day moving averages. I am watching the $INDU, $IWM, $SPX . The $QQQ actually broke its 50 day moving average today, so the next level may be the 200 day moving average down around the 65.60 level. I’ve been waiting for this move, as it may give some good long entry points after this big move up. I will revisit if these levels don’t hold over the next day or so, but my gut says the dip buyers will be there in force.

$SPX

$IWM

$DJIA

$QQQ The Nazzy broke the 50 day today, so next up my be the yellow line which is the 200 day moving average

This pullback is healthy and was long overdue even though the 1500 level came and went. If these moving averages don’t hold then it will be a different story, but for now, no time to freak.