{+++} The S&P 500 settled lower by 0.6% after today’s session saw an extension of yesterday’s selling. Equities began the day in the red and continued sliding into the afternoon when dip buyers showed up and lifted the major averages off their lows. The S&P 500 managed to hold the psychologically important 1500 level, avoiding its first close below that mark since February 4.

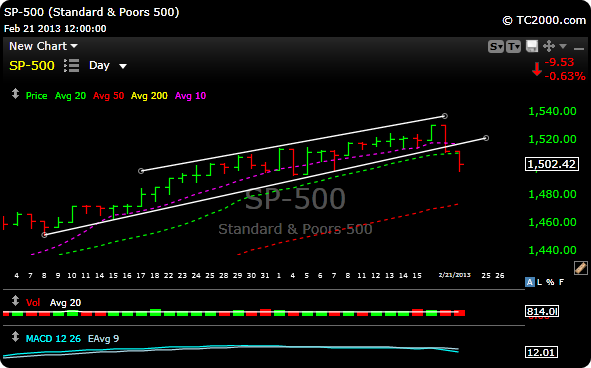

SPX-As you can see in the chart below, the S&P broke a very nice ascending channel that started after the 12/31/12 breakout. Although it held the “optically” important 1500 level today, it still managed to 1- break the uptrend line 2- break its 10 day moving average and 3- break its 20 day moving average. MACD has also turned down.

The 50 day simple moving average comes into play for the S&P at around 1473. That may be a possible target over the next week or so, or maybe not. Frankly I would love to see it, so we could enter some great stocks at better levels, but that may not happen as the dip buyers seem to be pretty aggressive and view any sell off as an opportunity to get long.

The Russell 2000 (IWM-ETF) also broke the same moving averages today and could have a downside target to the 87.60 level. I’m not saying we get there, but that would be a natural target if things get ugly. MACD has turned negative.

The Nasdaq (QQQ) has broken the 10,20 and 50 day moving averages in just the last two days. 65.60 may be the next target as that is the last moving average to test, which is the 200 day ma. MACD on this one turned down as well.

Anyway, corrections are good for the market. I’m still very bullish for this year and will view any further pullback as an opportunity to get really long.

Have a great night.