The Nor’easter that is Nemo has hit the northeast. Hope everyone is toasty warm. Here are some setups for your Saturday perusal.

The S&P ($SPX) continues to chop around in its sideways channel. This action really does validate the cliche of a “stock pickers market” as there are clear breakouts all over the place. Lately the market in general feels like it running in mud as it navigates a tight channel, but individual names are popping nicely. Just look at the charts of $ROC, $AOL, $GOOG (all time high), and $LNKD.

Here are some interesting set ups for next week.

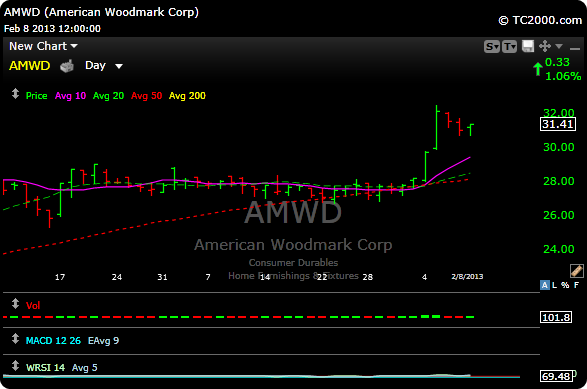

$AMWD– My subscribers caught this breakout last week around 29. The stock is now working a nice bull flag and is retracing beautifully on light volume.

$FNSR– I believe I posted this last week, still love the set up. Inverse head and shoulders, use the 10 day moving average area for your stop.

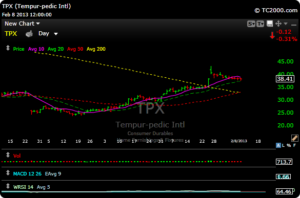

$TPX – This one broke out a couple of weeks ago and then had a follow through day higher. It is now in the process of a light volume retracement. It has also filled that follow through day gap. The 50 day moving average s also trying to cross up through the 200 day moving average.

$PVA – I put this in the “everyone loves a cheapie” category. This one broke out last week on good volume and is now showing a pretty bull flag. Look for an initial move to the 200 day moving average around 5.50.

$CRZO Stock is working a bull channel just under the 200 day moving average (similar to the $DVN set up I posted). Could breakout at the 22.80 level.

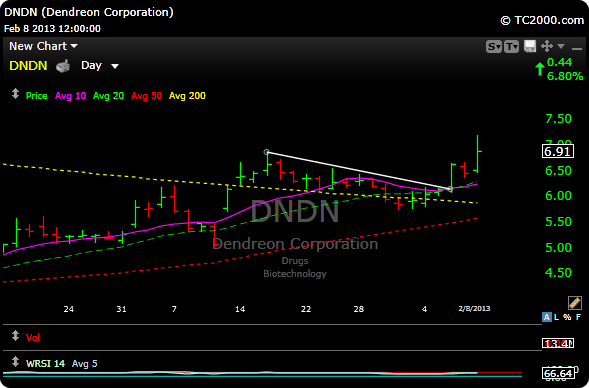

$DNDN – Broke out above its 200 day moving average last week on volume. It also managed a close above the 50 day moving average on the weekly chart. It is up against some resistance that goes back to June, but if it can get above that, I see targets of 8-8.50

Have a great weekend. Come by for a free trial here