{+++}

Things were just swell until about 2:30 today. As a matter of fact the market looked like it may have been trying to stage a rally. Then Harry Reid took the microphone and telegraphed how unhappy he was with the progress of the fiscal cliff discussions, and BAM!!!, a quick 75 point hit for the DOW and about a 10 point drop in the S&P. Powerful speaker, fireworks.

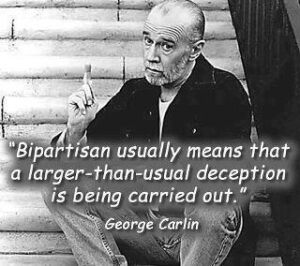

It looks like we are now Europe circa 2011, as our markets are being held hostage by sudden headlines and sound bites from our politicos. Europe had Drahgi and Merkel, we have Boehner and Reid. Oh joy. Like a lawyer who tries his case in the media, so will our elected leaders. As a result, you can expect massive market chop until this mess of a cliff gets resolved. It’s all fun and game until someone gets poked in the eye. Both sides of the aisle will test our last nerve before this is all over. They will play their reindeer games, saber rattle, and jockey for position to our detriment. It is what they do best.

I say we take all the progressives on the left and the neo cons on the right, lather them up with Twinkies and drop them in a field of Siafu ants. We then start a legitimate third party comprised of sensible people from the left and right and get this all fixed. It would take little more than a weekend if done right. Yet I dream grand dreams, and the dramedy continues.

Anyhoo, today may have been just a hiccup in the grand scheme of things, as many charts look good and some were starting to set up very nicely. It would be a shame if these broken men break this tape just to prove a point, but it is what is.

$$AAPL still looks good, but still needs the juice to tag that 200 day moving average, which is about ten points away. $GOOG woke up today and managed a close above its 20 day moving average. I still like tech, but the financials need to jump in the sandbox if this tape wants to go higher.