{+++}

I am doing the weekend post today just in case I am with out power tomorrow. Governor Christi just issued a mandatory evacuation foe anyone who lives three blocks or less from the beach. My family and I are ten blocks out, so whatever is coming probably wont be good. Christie is also warning that folks in my area could be out of power for up to four weeks. My generator arrives on Monday morning, hopefully.

There is a possibility that Wall Street will be less populated on Monday, although the bad stuff is supposed to hit on Tuesday. My office is also south and near water and I will be making every effort to get there on Monday to trade, power permitting.

Anyway, it is what it is. I know some of you live on the east coast, so good luck and stay safe. I am busy getting prepared, but wanted to give you guys a post for next week.

I am not as bearish as most are for next week. I am actually more bullish. The S&P did a pretty good job of holding the 1400 level last week, and that’s a level that is psychologically significant.

The Positive

1- Technically we are short term oversold in a big way. We have corrected now about 65 S&P points (75 if you count the intraday low on Friday.)

2- We are still in thick of earnings, but many of the “big” names are out of the way.

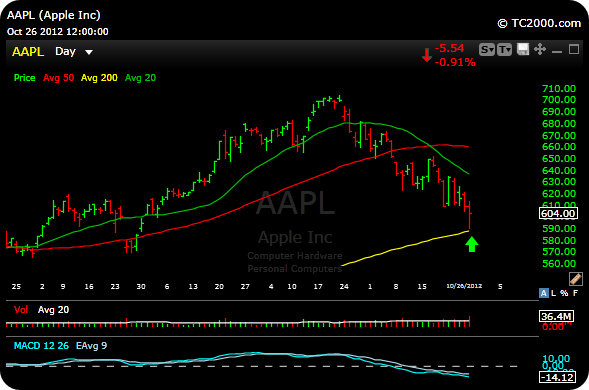

3- The Nasadaq, whether you follow the NDX or QQQ, both successfully tested their 200 day daily moving averages on Friday. All the bad news and uncertainty regarding AAPL is out of the way. As I wrote last week I thought the market was having a case of paralysis through analysis last week because of AAPL. AAPL also came within a couple of bucks of its own 200 day moving average on Friday. You can see both charts below.

QQQ

I find the Russell 2000 interesting and still perhaps ready for a big bounce. As you know we are long TNA which is the bullish ETF for the Russell 2000. It does like like a bullish falling wedge to me (so far) it will need to hold the yellow line which is the 200 simple moving average.

Don’t get me wrong, we are not in calm water yet, and we still have earnings to come and so far they have been horrific, I do think though that the market is in the process of discounting that and will start to look forward again soon.

All the old warhorses like GOOG, AAPL AMZN, IBM and others have failed miserably during earnings season.

Here are some names I am looking to buy this week. Please see the P&L tab on the blog for stops.

1- AON–over 54.30

2- BLDR- over 5.25

3- JO- 36.70-37.65 level

4- LNG- over 16.38

5- MLNX- 72 to 74level

6- MM-over 16.70