The market is more nervous than a hooker in a confessional right now. The sell off in the euro means business and the globe is in “shoot first ask questions later mode”. It goes down as I write this. What a crazy day today. We had a Russell 2000 re-balancing and stocks were all over the place. $AAPL gave me heart attacks about four different times today. Still my favorite stock to trade.

I’m long the euro via $FXE, I’m down a couple of bucks in the trade. If I was short the currency, I would be hurting. But I didn’t, so I’m not. Thankfully. I have enough stress with stocks.

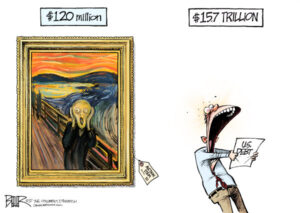

I have been around long enough to know that two things happen when a market, stock, currency or ETF trades at these extremes. Either everyone is leaning the wrong way, or they are correct in their thinking. If the market is truly correct, then we are all screwed. If the crowd is right, then the euro and Europe will implode and we will probably see a 100-200 point crushing of the S&P. Fast.

I’m not saying we bottomed or going higher tomorrow. What probably needs to happen is a test of the $SPX 200 day moving average. It would amaze me if it didn’t happen. That number is roughly 1284. Looks like a magnet right now.

I had the S&P and euro chart next to each other all day. Amazing how they trade together. Kind of like $AAPL and the $QQQ’s. It’s all Europe right now.

If we break the 1280 level on the $SPX with conviction (meaning a panic sell off in Europe), my plan is to release the hounds of hell to the short side. I’ve done it before and i will do it again. Frankly I haven’t been short this tape. The trade doesn’t work, it hasn’t worked. It has lately though, as we are down big. Can’t get em all. Was mostly cash on the way down though. I saw stops.

Sell in May and go away has been spot on. The $RUT lost about 9%, Asia -10% Spain/Italy-6%, Crude -16%, Copper -11% gold -5.7% Nazz -8% DOW -7.2%. Those are ballparks but pretty close. The Russell 2000 had its second worst month in history for May.

Japan is in a Depression (I don’t care what anybody says), and I trust China’s numbers like I trust Jon Corzine with my kids custodial accounts.

Commodities of all types are getting wrecked. The risk off party and the big deleverage is in full throttle right now.

It’s tough looking through the fog of war. So tough to see things clearly.

On the plus side I think the feared fiscal cliff will be avoided, these ham sandwiches in Congress will figure it out. Europe is close to floating into the Mediterranean, so I think something will get done sooner than later on that front. Our growth is anemic, but we hang in there. I still think this happens.

I could just as easily make a case for a crash. All the stars are aligned. But as I channel my best contrarian, I feel we rally soon. Tons o’ cash.

However, I will become a grizzly bear on a break of 1280.

Down about 1.5% for May. I suck. Should have killed the short side. Yet I feel victorious.

Shorted $TLT today, still long $AAPL, $FXE, bought $JOY off the bottom, saw some stops. That’s life.

Jobs tomorrow.

Subscriptions here.