{+++}

The market experienced an extreme reversal late in the day as some of the ratings agencies made some comments on out banks. Basically they said the banks are able to currently withstand exposure to Europe, but that it bears close watching.. Basically they said if Europe doesn’t figure something out soon, they could change their opinion. This was the Fitch rating agency by the way.

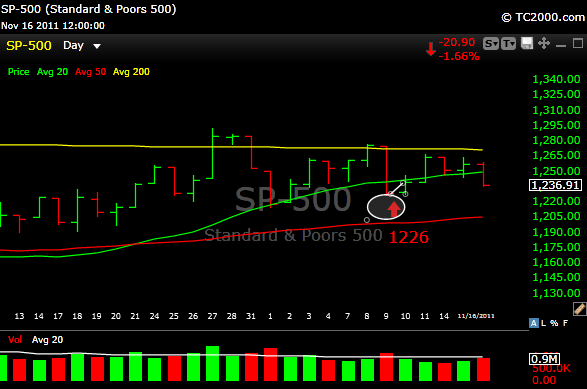

By the way I highlighted the 1226 S&P level to watch as support tomorrow. It may be a key level.

Also, Moody’s went negative on some European banks today, so the combination weighed heavily on stocks.

The commodity space was doing well up to this point as the Euro had gained some strength and the dollar was hitting session lows. All of the energy names were looking good, but when the rating agency comments made the rounds, the dollar rallied against the falling Euro and that put pressure back on energy.

I sold a 1/3 position in UCO +$4.00 and I am holding the balance. I also added two more energy related names, OIH and APA. I also added ALXN which has reversed on the charts (good volume) and appears to be turning a bit more bullish. ISRG, DPZ and RVBD sold off with the market.

As you know I have been bullish on oil and energy and I will continue to be. Saber rattling over in Israel and Iran is gaining some traction and the rhetoric may indeed heat up. As a result I think exposure in the energy space is still a good place to be.

Hopefully the situation can stay contained.

Please check the P&L as I tightened up some stops.

Hang in there and I will see you tomorrow.