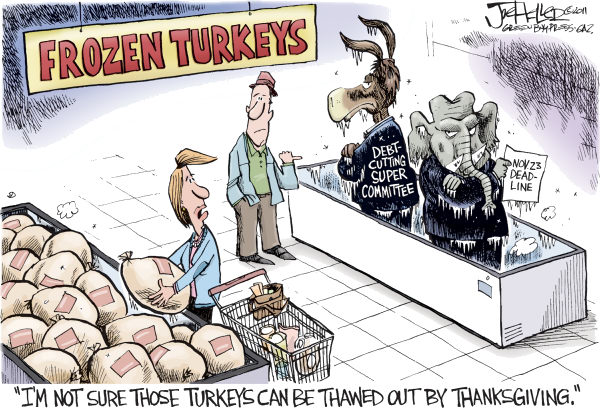

Only about a week is left for the group of six Republicans and six Democrats to craft a plan that will slash $1.2 trillion from the U.S. deficit during the next decade. If our elected wizards can’t figure something out, deep and automatic cuts to Medicare and defense spending will trigger. The deadline is November 23 which lands next Wednesday. If they can’t get our house in order, look for more rhetoric about another U.S. downgrade and look for the market to go lower. Right now it’s a coin flip. Based on their track record, I’m not feeling all that warm and fuzzy.

Futures are getting hit yet again this morning. Mario Monti is facing big resistance with the formation of his cabinet and European markets are seeing decent selling once again. I would continue to watch Spain. $EWP and Italy $EWI. Greece has turned to pixie dust, so you may want to watch Germany too, $EWG. I am still waiting for the downgrade of France, $EWQ, it’s coming. Some say its been discounted, I beg to differ.

Yesterday was one of the lowest volume days of the year. It feels strange out there to say the least and the choppiness is ridiculous. $AAPL broke its 50 day moving average on Friday, the volume was big and it now looks like it may want to tag the 200 day moving average down around the 360 level.

It’s a big data day today with PPI, advanced retail sales and Empire manufacturing are all on the docket.

There is never a dull moment and caution is advised.

To learn more about my Premium Service please email: [email protected]