It was the worst quarter for French, German and UK stocks in nine years. If you see the chart above it appears our market peaked (at least for now) at the top of that wedge. We closed on Friday (on the lows) at the bottom of the wedge.

We know that the two layers of support for $SPX are 1120, then 1100. The question is will we gap on Monday to test the 1120 level and get it over with, or bounce around some more and rally higher?

I haven’t a clue what Monday will bring. Back in the day when stocks closed violently on the lows, the next morning we would most likely follow through lower at the open. We now find ourselves in such a headline market, so anything can happen from a piece of news. The last quarter of the year is historically good for the market. That doesn’t mean we cant knock out 1100 and kiss 1040 which I think is a distinct possibility before we get happy feet again. Nothing goes straight down and there will mind blowing rallies along the way.

I think we will end the year higher than where we are now, the action in between though will be epic.

It looks like gold $GLD …….

…has been replaced by Treasuries $TLT for now as the place fear goes to hide.

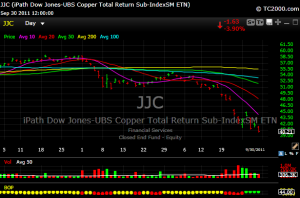

Look what has happened to Copper $JJC, a great global “tell”

Energy is collapsing, $XLE

Agriculture is in a death spiral. See $MOS, $CF, $POT etc…

I think the financials are dying and will go lower, $XLF

Morgan Stanley $MS, under the right scenario could see single digits.

In case you woke up late, Goldman $GS ain’t hot anymore.

I could go on and on. In all candor, these charts look like 2008 to me. Will history repeat? Who knows. As I said, there will be great rallies along the way regardless of where we land.

Just play the tape.

My Premium Site has been short and in cash throughout all this ridiculousness. If you would like further detail, nightly guidance (stock selection, long and short) via my Premium posts or to request performance, email: [email protected]