“The Bernank’s view may just be, hey, why not? That’s why he’s turning to a scheme hatched fifty years ago. The central bank is thinking about juggling its $1.7 trillion portfolio of Treasurys to hold less short-term junk and more long-term junk, hoping to push already-low long-term interest rates down further. This way more minimum wage employees can go get mortgages again. I always said the best way to fix a bubble is to immediately start another one. Japan has just been adorable the last ten years with their zero interest rate scenario. A true model for all countries seeking inertia and failure.

So now we wait, yet again for Princeton’s best academic to maybe do something to save the bacon of the longs and further crush the income of starved retiree’s. However, Ben probably wasn’t on the football team and probably wasn’t “in with the in crowd” as a younger dude, so this is his chance to make a splash of biblical magnitude and just be so cool. Hey, he just may.

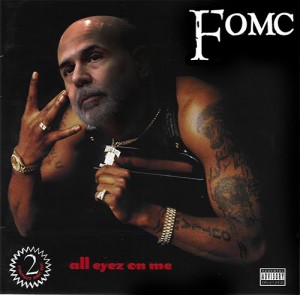

$SPY, $QQQ, $UUP, $FED