” We have sold 40% of our bank holdings, but I wish we sold 80% because they have been acting like crap since we sold”– David Tepper

So what’s left in the Fed’s central planning toolbox? Not much and whatever it is, it wont be any more quantitative easing. Can banks and stocks exist without the needle in their arm? We’ll see.

Back in the day, banks made money from lending. Before they blew up the universe loaning 800k to doormen in Astoria Queens for waterfront homes in Palm Beach. That’s over, done, finished. Now they lick their wounds and kick the can down the road, keeping those doormen in their non foreclosed homes so they wont have to report the real hit to earnings. They hide some of this behind the complete farce that is H.E.M.P. or mortgage modification. A massive failure by this administration.

The big carnival act for the last couple of years for the banks has been borrowing from the Fed at almost zero and loaning to the Treasury and making the spread. That is over. Bookies all over the world wished they could have had a piece of that layup trade.

Now the banks have had their big wheels taken away and have to ride a two wheeler. Good luck. They still won’t lend to individuals or small business and that sweet piece of business called proprietary trading has been shut down. So it’s back to basics. But they won’t lend. Derivatives (so lucrative) have for the most part vanished as an asset class, although the ones that are still around (no one can understand them) are still completely unregulated. Can you say “history will repeat”?

I listened to an interview with the CEO of Johnny Rockets, a 1950’s themed burger joint yesterday. Decent burger, kids love it. The question was asked if banks are lending to him as they are really starting to expand. He said that bank money was beyond tight. He went on to say that his franchise has to lend money to his franchisees for expansion and they lend at a cheaper rate than the banks would. Is that the future? Maybe for now.

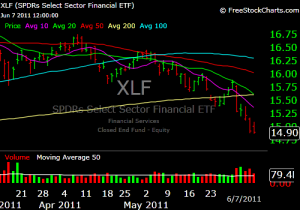

The pundits have loved this sector for months, what they saw I will never understand.

For information about my Premium Site email me at [email protected]