{+++}

Broad buying in the early going gave stocks an opening gain, but the market’s failure to extend the move beyond near-term resistance brought sellers back into the fold. Stocks eventually battled back for a mixed finish, though.

After the close, JBHT and UFPI was the most notable names that reported. The big kahuna, GOOG reports after the close tomorrow.

Tomorrow morning before the open, two economic reports are scheduled to be released: 1) Initial claims (Consensus 385K) and Continuing claims (Consensus3700K) and 2) PPI (Consensus 1.1%) and Core PPI (Consensus 0.2%).

JP Morgan led things off for the financials and the reaction was mixed and the stock closed red for the day, Oil stocks were lower, but crude bounced a bit. Materials, steel and coal all were week and the financials were soft. The President spoke on the deficit and the market stood still during the speech, but the market closed slightly higher than when he began the speech. All in it was a choppy day with RVBD rallying on a good earnings pre announcement, stocks like FFIV and VMW caught a bid in sympathy.

Please note that RIMM and THOR both triggered yesterday, but I goofed on the P&L last night and omitted them. It has been corrected. I also added three new shorts today: AFL, GES &DBL. I also covered the last 1/3 position in ROVI.

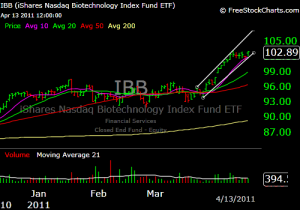

On another note, I have been asking myself where money may continue to flow. Commodities are taking a breather and so far tech and financials are just flat. Biotechs look good and the charts look strong with good volume. I am adding IBB and AGN tonight as longs. If you are more risk averse, there is less headline risk in IBB as it is the ETF for the sector. Good luck tomorrow and I will see you in the chat room in the morning. Check the P&L too for entries, stops and any adjustments.