{+++}The “soft stuff” lead all commodities today, posting a 2.1% gain. May sugar rallied for 3.6% to finish at $0.2922 per pound, while May orange juice finished higher by 2.9% to $1.7115 per pound. After the close, AEM, BBRG, CAR, CBS, CLF, ESRX, NTAP, NVDA, ORLY, RBCN, SKX are the most notable names that reported after the close.

Eight of ten sectors were in positive territory, led by energy (+1.3%), materials (+1.2%) and consumer discretionary and info tech (+0.8%).

Tomorrow morning before the open, two economic reports are scheduled to be released: CPI (Consensus 0.3%) and Core CPI (Consensus +0.1%) and 2) Initial claims (Consensus 408K) and Continuing claims (Consensus 3900K).

Tomorrow before the open look for the following companies to report: TDSC, ACOR, ALR, ARGN, ANAD, APA, ARIA, AVA, ABX, BGCP, BXC, BBW, CAB, CPO, CRY, DPS, DUK, DEP, ECL, EPD, RAIL, GTIV, GEO, HOS, UN, H, ISPH, SM, KSWS, BW, LTM, LIZ, YPE, NNN, NXY OHI, ORB, PCG, PNCL, PDC, POOL, PDE, RS, REV, CHS, SPNC, SPW, STFC, STRA, SYNT, TBL, TTC, TRW, ULBI, UAM, VCI, VDSI, VTR, WM, WTW, WST, and WMB.

I took a partial profit on COF and I re-added MCP to the list and new addition OIL. Crude has come down from $95 a barrel to just $85 a barrel in just 10 trading days, so I like the OIL trade as a swing trade long going forward over the next two or three weeks. IDT is a very frustrating stock, it’s the only position that I ever get an email on, so trust me, I feel your frustration. It is the demon son of MCP in all honesty, but I am leaving it on the list. I know many of you held through the stop, but if you got stopped, and some of you did, you can re-enter around this level if you want to continue to dance with this devil. It held the 50 day simple moving average which is where initial support is, but I will lower the stop to the 20 day moving average which is around the 24.50 level. This is probably the only stock I have such patience with, but I believe if it can shake out some weak hands it has a shot of powering higher.

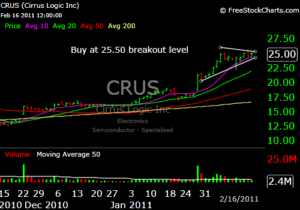

The market seems tired, but some charts still look terrific from the long side, here are some set ups to watch over the next few days: