{+++}

Stocks staged a late session rally as strength in financials, energy, and materials propelled the major indices to minimal losses (Nasdaq -0.4%, S&P 500 -0.1%) after seeing heavy selling this morning on European debt fears, and growing tensions on the Korean Peninsula. Stocks moved off their session lows following the completion of the second Permanent Open Market Operation of the day. Today’s operations allowed dealers to rid their books of $9 billion worth of Treasuries, and possibly put that money to work in equities.

Seven of the ten sectors were in negative territory, led by telecom (-0.95%), consumer discretionary (-0.61%) and tech (-0.60%).

Tomorrow morning we see the following reports:

09:00 US Sept S&P/CS Home Price Index, Sept S&P/CS Composite-2009:45 US Nov Chicago PMI10:00 US Nov Consumer Confidence11:30 US Treasury’s 4-week bill auction14:00 Fed’s Discount Rate Minutes16:30 API Crude Oil/Gasoline/Distillate Inventories

Today ended well and on a positive note, but if you were anything like me, the first half hour I was dry heaving and pissed at being pretty long over the weekend. When this happens you have two choices, man up and buy a little (sticking to your convictions) or sell the farm (that’s OK too) and take losses. Both can look great in hindsite. It’s the hardest thing in the world a trader has to do.

As you know, we have been long biased for a while and it would be nice to see a follow through day to the upside tomorrow. The problem is we are one firecracker away from a sell off from Korea or one sell off from panic in Portugal and/or Spain now. Both of these issues may have been temporarily placated for now, as today went without a hitch.

I’m still long and many of our names acted very well today. SOA, BTU, ASYS and WYNN triggered and many of our other names rallied back with the rest of the market. The Santa Claus rally is still a possibility, but the geopolitical front is not making it easy at all.

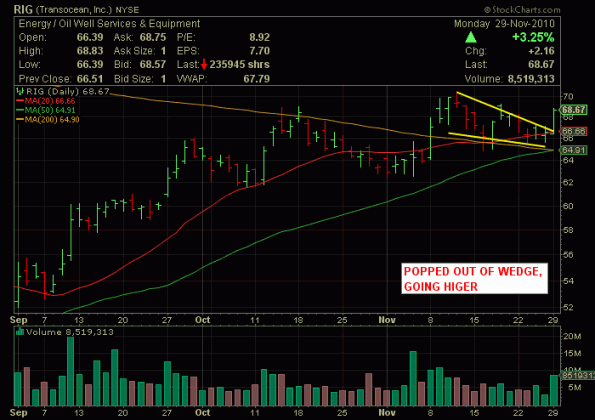

I have added RIG as a long tonight. Here is the chart