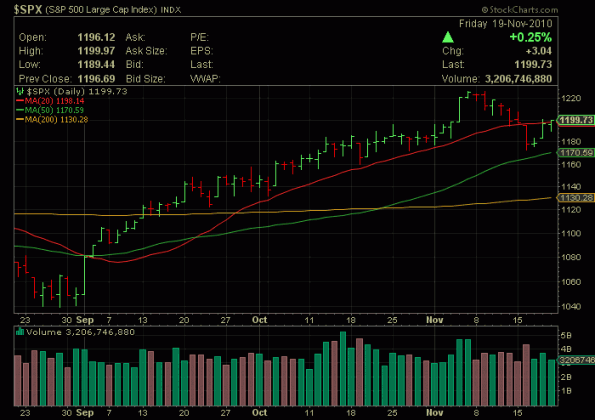

Much adieu about nothing? Look at the S&P, really no change from where it opened on Monday, but we thought the jig was up when we laid our heads down Tuesday night. Ireland’ woes and China’s strength were the culprits. Ireland because they might go bust and China because of its tireless and robust economy that may need cooling off with a rate increase.

Commodities, metals and materials took a trip to the woodshed on Tuesday but all had a strong rebound Thursday with a slight follow through yesterday. The dollar rallied hard and had a close above the 50 day moving average on Tuesday, but has had three consecutive days lower , but still managed a close above the 50 day moving average. Next week should be interesting.

It’s been a nice November so far on my Premium Site. and the chat room has been a great flow of timely ideas. Some winners just in the last two weeks include: SOA +14.0%, SOHU +5.0, CNX +7.0%, NFLX +3.0%, IDT +17.0%, CML +5.4%, LULU+3,7% ,RVBD +2.6%, MEE +4.0%, FSYS (short) +2.8%, MMR +3.8%, FSLR (short) +12.0%, VHC (short) +12.0%

For performance results or subscriber testimonials please e-mail me at [email protected]

Have a great weekend and enjoy the links.

Do you use an ‘expert network’? What could be a huge insider trading scandal.

So why do you want to be a trader? (video and some language) Models and bottles.

Blockbuster IPO’s..Where are they now.

Tech bubble…already?

Meredith Whitney to start her own credit agency.

Will Ireland’s woes release the Portugal vigilantes?

Lloyd Blankfein-Sun God

GM’s first trendline and resistance.

Geithner warns

Why China tightening matters.

Scrambling for rare earth.

Few businesses starting up.

Facebook generates 1 in 4 page views.

Orange County crib sells for $34 million.

What’s on tap for next week (the snippet video is excellent, it ain’t flash trading though)