{+++}Stocks faltered in the final hour of trade to finish the day with a fractional loss. The slide came in the face of leadership from financials and some upbeat retail sales data. After the close IOC, MCP, JWN and URBN were the most notable names that reported after the close.

Six of ten sectors were in negative territory, led by materials (+1.4%), energy (+1.3%) and tech (+0.8%).

Tomorrow morning before the open, one economic report is scheduled to be released: 1) PPI (Consensus 0.8%) and Core PPI (Consensus 0.1%).

Thanks for stopping by our first Webinar tonight. There were a few hiccips, but they should be resolved by our next go round.

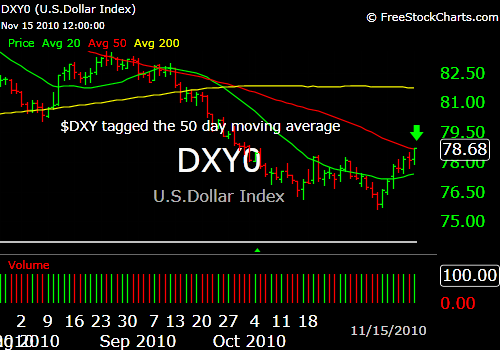

We gapped up, consolidated, moved higher and them around 2:30 we slowly rolled over as the dollar really started to take off. Oils and materials gave back their rally attempt.

The fertilizer space is also under pressure

Some of the leaders are pulling in. Is this just a minor pullback or the start of something bigger? 1160-1180 may be a level that the SPX wants to retest, but there is much cash on the sidelines and performance chasing by the institutions could kick in soon, which would be bullish.

I have always had a very bearish leaning, but I’m not convinced that this is the ‘big one’ and am still leaning bullish. I was chopped up a bit today and so were many. Let’s get back at it tomorrow.