{+++}The stock market climbed as much as 1% to set a new five-month high, but the move failed to hold amid a bounce by the dollar. After the close AMZN, AXP, BIDU, BUCY, CMG, RVBD were the most notable names that reported.

All ten sectors were in positive territory, led by consumer discretionary (+0.7%), industrials (+0.7%) and health care (+0.3%).

Tomorrow morning before the open, no economic report is scheduled to be released.

Tomorrow before the open of the many companies to report, some of the bigger names include: AAI, EXC, HON, IR, KEY, ERIC, MBFI, SLB, TROW, and VZ.

It’s been the choppiest week or two for us, perhaps in a couple months, and as one of the chat room fellas said today, “you could probably be long or short and end up being right in two days.” That goes perfectly to the recent volatility of this market. I don’t like paying my trading platform more commissions than I have too, but as you know, I am very cautious up here at these levels and I think I warned last night that I may have a quick trigger finger if longs start reversing. Preservation of capital is more important than making money at the end of the day.

AMZN is down in after market trading, the number looked good , but margins were suspect. I believe we get a late report tonight from BIDU and that will certainly have an effect on futures later on and into tomorrow’s trading.

We tagged 1189 today and the battle at 1190-1200 could be epic, if we get there. I am watching the short Euro, long dollar trade here and may take some action there very soon. There is much chatter out of Washington that we may take a stand on the dollar. If it does turn from rhetoric to reality, there will be amazing opportunities on many fronts so stay tuned.

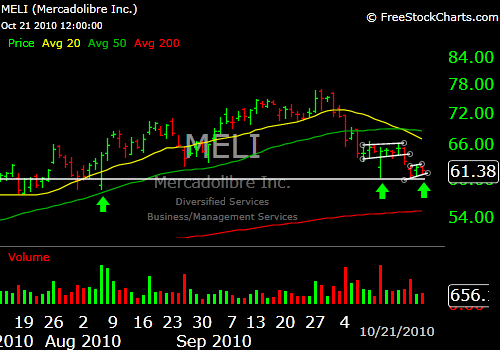

I have added some names to watch in the coming days. Depending on market action they could be removed quickly. More names are setting up, long and short, so we will need a few more days to validate. See P&L for entries and stops.