I have always hated banks, odd for a passionate capitalist I know, but I hate them just the same. I hate their hidden fees, their nickel and dime approach to everything, ATM fees and the collective room temperature IQ of your average teller. I released my vengeance on the financials during the great crash/deleveraging of late 2008 and part of 2009. All their dirty sins were exposed, and places like Wachovia went to pennies a share. I include lenders and all investment banks in this, as they were the enablers and completely complicit to the crime that eclipsed all others. Enron, Tyco and MCI was choir practice compared to the banking fandango. I liked being short the financials everyday, as I waited for the 3PM trap door to open (which happened with almost uncanny precision on a daily basis). The risk managers at all the big hedge funds would give the “time to sell” call as the redemption notices piled high and could no longer be ignored. They waited until late in the day, hoping on hope that bids would show up. They never did. So the selling began.

On March 9th, 2010 the $XLF traded to an all time low of $5.97. Rome was burning to the ground and our nation was on the brink of the Apocalypse. We all know that we bottomed there and it became the greatest story ever told.

So what’s next for the market? Another big leg up? Maybe we crash again along with our dollar. I say look at the financials, for that in my humble opinion, may tell the story. The financials usually do tell the story and the sector has always been my favorite “tell” for the market. You can take your MACD, oscillators, VXX, VIX, relative strength, put call ratios, stochastics and push them to the side. For it is $XLF that will show you the way.

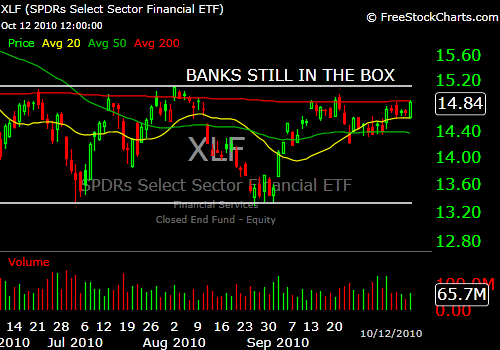

I’ve talked about the “banks in the box” for a while now. That for me is the low range of approximately $13.30 level to the high of $15.09 that was put in on August 2 of this year. The XLF tagged a high of $17.09 back in early April but faltered and has been in a “range” ever since.

For me, $15.09 is the magic number. If $XLF can breach that $15.09 number (accompanied by huge, and I mean huge volume) that for me will be the “tell” and the signal for another leg up for the market. A fail there and this punch bowl goes dry faster than you can imagine. From my perch, banks are still zombies wrapped in the bow that is QE2.

A touch and fail at that level could be the green light to get short with semi reckless abandon. We may find out soon as $JPM kicks it off with their report tomorrow morning, then we see BAC, C, GS in the days ahead. I see zombie homeowners everywhere.

Fun stuff and why we play the game.

Premium Content here. For performance results please e-mail [email protected]