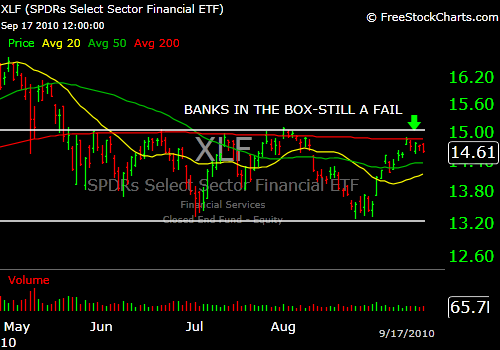

The conversation is all about breakouts or rollovers here. The SPX is flirting(and ever so close) to a breakout, and the XLF traded to the penny to its 200 day moving average and was turned back. A pause that refreshes before the “big move” higher, or is the market telegraphing its exhaustion for the “big move” lower? I’m agnostic, but things do look a bit long in the tooth, even though some charts look glorious. They looked glorious in early August too, before the trap door opened.

Good luck next week and enjoy the links. I’ve had about an 80% win rate on the September P&L on my Subscriber Site, if you would like a copy just send me an email.

ETF roundup.

Poverty rising.

The DOW 30 is the kiss of death, it has become irrelevant anyway.

OPEN…a big premium to make a reservation.

Me on Quest Software.

The best and worst private equity funds.

At least a broken clock is right twice a day. Prechter comes out of the woodwork…..again.

Interesting insurance stats

Bank merger mania?

How is Keynes working out for you?

Lost the battle of facts? Just change the name.

Why Democrats can’t win on taxes.

The wife of Harbinger Capital.

Premium content here.