OK, I’ve talked about the financials for two years, since I started the blog, but lately have beaten to death my concept of “banks in the box”. For you newer folks, that is the phrase I use to describe the range that the XLF has been in from early May to present, and all the gyrations in between. It is basically the range between $13.34 on the downside to about $15.09 to the upside. Today the XLF closed exactly at the 200 day moving average….exactly. On 8/2/10 it traded as high as 15.09. but closed at 15.08. A close above that high level would be bullish, but it will need to hold.

This is the place where XLF blasts off or fails, pretty much the same can be said for the S&P. 1130 is the level of resistance. The rest of the week will be interesting to say the least, as the XLF & S&P fights for higher ground.

Please check P&L as stops have been adjusted.

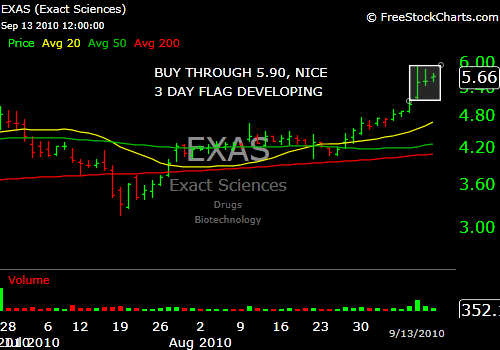

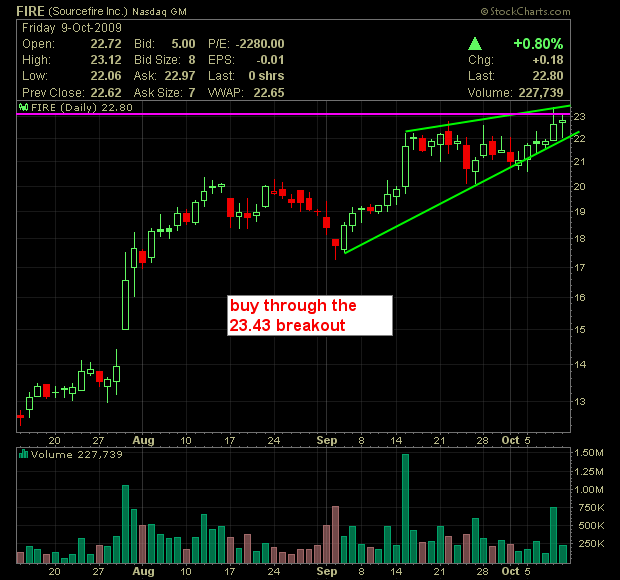

There continues to be some nice set ups, so here are a few potential long breakouts for tomorrow: