{+++}

Today was interesting, as the market put in in a nice reversal off the lows. Market participants were dealt another dose of disappointing data, but stocks worked their way higher and eventually benefited from a late-session squeeze that helped them book their first gain in five sessions. After the close CYBX, GES, HAIN, HEI, JAS, JDSU, KONG, RUE, SIGM, SMTC and TIVO were the only notable names that reported after the close.

There “may” have been a short term bottom put in for the bond market today as the flight to safety may have in fact been slightly overdone. I have posted two charts on TBT, the first one shows today’s chart on the 15 minute, notice the gap down, bottom, then reversal. If a bottom has been put in, it’s bullish for stocks as risk may get put back on. It may only last for a few days, but the market will take what it can for now.

Notice the daily chart to the left. It looks to me like the selling “may” have been overdone. We’ll see.

We’ve talked a lot about the XLF and as we thought might happen, the ETF broke the early July low today, but as I stated on the chatroom , that level is also the level that in the past, it seems to find the moxy to start a rally.

We will see where we go from here, but it wouldn’t surprise me to see an oversold bounce here. This market allows us ZERO time to get comfortable. No sooner do we lay out some longs then its time to sell (or stop), we enter some shorts and it’s time to cover. Tough market for sure.

The market closed fairly strong which may indicate that a bad jobless number tomorrow “may” be baked in. Again, we’ll see. GDP is on Friday and Michigan Consumer Confidence gets reported, both will be market movers.

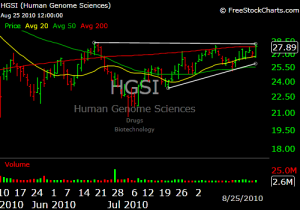

One reversal does not a trend change make so let’s watch what we have for now. I added HGSI as a long today as I have been watching it for a week and it has acted extremely well through this tough market. It needs volume to break through that 28 level with some authority. Also AGP has been on the list and I moved up the trigger with an “anticipatory”trade. The chart looks great, and it too has acted well in this ugly tape.

My stop on UYM was tight and we stopped , but watch it for a long if the dollar weakens in the coming days, also I like XLE (as I think oil is way oversold), I love OXY but it has stopped again and I need to take a breather on that one for now. It’s one of those stocks that I just can’t seem to get right although I think it will be 30% higher by year end.