Corporate earnings were more mixed this week, with hit or miss corporate results replacing the strong positive tone that sent US equity markets higher last week. Earnings from the major oil firms were very strong and a mid-quarter guidance boost from FedEx helped early in the week.

Corporate earnings were more mixed this week, with hit or miss corporate results replacing the strong positive tone that sent US equity markets higher last week. Earnings from the major oil firms were very strong and a mid-quarter guidance boost from FedEx helped early in the week.

The Q2 GDP data lagged expectations somewhat, while the big upwards revision of the final Q1 reading (to 3.7% from 2.7%) made the Q2 data look even more disappointing. The semi-annual benchmark revisions painted a bleaker picture of the Great Recession, showing that the US economy shrank 4.1% in the period from Q4 of 2007 to Q2 of 2009 (the prior figure was -3.7%). The revisions also showed household spending fell 1.2% in 2009, twice as much as previously projected, for the largest annual decline since 1942. Fed Governor Bullard added to the overall risk aversion theme. Bullard warned that the Fed’s ‘extended period’ language carried “Japan-like risks” and that deflation was a real threat to the US economy.

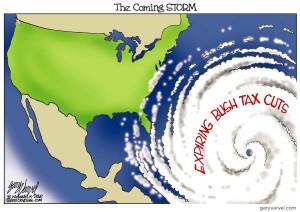

We are on the back nine at the Wall Street Open and July was a pleasant surprise for traders, so what will the second half look like.?We have the November elections close by and the conversation about the extension of the Bush tax cuts and the budget deficit that grows as fast as a summer zucchini, will take center stage.

Wall Street hates taxes and deficits and no matter what side of the aisle you find yourself, an expiration of the tax cuts will pound the market in my view. If the leadership acquiesces and lets the tax cuts extend, fasten your seat belt as the rally could be a monster of biblical proportions.

Here is the current and proposed tax situation:

Top Inc. Tax Rate ,,current 35% Jan1, 2011 41%

Capital Gains Rate,, current 15% Jan 1,1011 20%

Top Dividend Rate,,, current 15% Jan 1,2011 39.6

Estate Tax ,,, current 0%, Jan 1, 2011 55%

Here is a peak at the budget situation:

Federal debt will hit 62% of GDP at end of 2010

That’s up from 36% at end of 2007

The only other time it exceeded 50% was during WWII

Many moving parts as we hit the home stretch and the trading should be fast and furious. This wall of worry may start to get real slippery.

We had a blast on the Premium Site last week so come on by and check it out. Enjoy the links.

Britain now want to decentralize health care, we can’t centralize it fast enough.

The history of home values.

The shorts are back in the banks.

Sector performance earnings

Those wily Whly brothers

The idle rich and their issues.

Crime in China’s mine shafts.

Banking the unbankable

Call off the search party.

Financial Reform; what it doesn’t do.… a lot

I worked for this dooshbag when I was young punk at Bear Stearns.

A triple bottom break for WHR.

Inside Bunny Mellon’s estate