{+++}So today was the great face ripping G-Force rally that I felt was coming. We were a day early, although we did take some great long side trades yesterday. We saw a great gap up yesterday and we took some profits,and then went short some horrible looking charts as the market fizzled and gave up gains. I’d do it the same way again as that is how you are supposed to trade. Rallies that fade in bear markets should never be held.

Today was a different story, and the difference between today’s action and yesterday’s was this. Yesterday the market gapped up, traded sideways for a short spell then started a steady descent. Today, we opened flat and built steam all day and all sectors participated, so the breadth of the market was strong. Yesterday was weak by most accounts and volume was weak, but we go up and down on light volume anyway, so we’re used to it, (although our down days have been on higher volume than up days).

I think we could now head to the 1080 level if we can catch some follow through tomorrow, although a bad retail number (8:30 am tomorrow) could get in the way. A decent number though, could be the catalyst for higher prices.

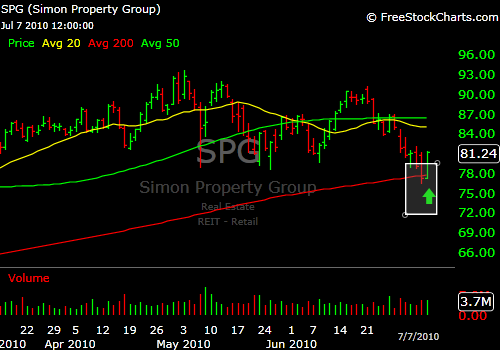

We’ve been long DRN a bit lately, which is the 3X long ETF for commercial real estate. It may be moving higher and here’s why: SPG, VNO and JLL, three of the components ,may have seen a short term bottom. We’ll see, but look at the charts, they look interesting. Could be more in store for the sector and I will let you know if we enter. Notice how they held the 200day MA.

I have added two longs tonight: APKT (one more time) and LLEN, please check the P&L for entry prices and stops.