{+++}Today was a bit of a whippy chop fest as opposed to an all out throttling lower, although at a couple of points, it looked like the trap door was really going to give.

Odd day as some of the momentum names like FSLR and PCLN, that have been getting hit hard, actually went counter trend and performed well.

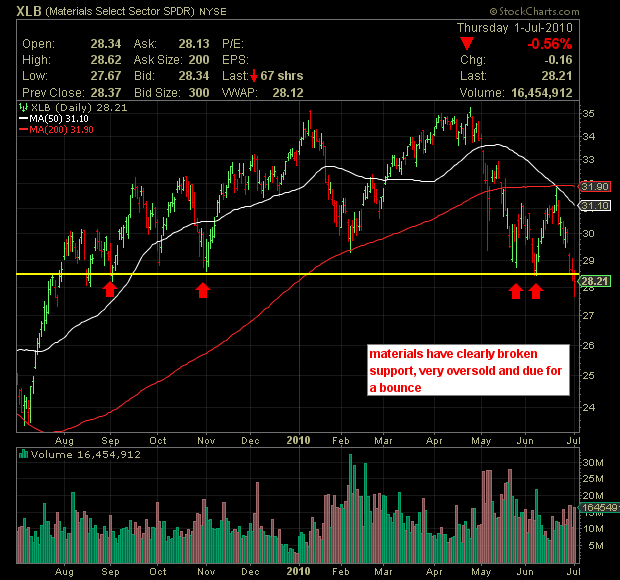

Materials were down but came back from their lows and the financials (XLF) which broke KEY technical support, manged a bit of a rally and managed to close above the level. Was today a reversal day, I’m not so sure, as volume would have been better and the rally would have had more legs.

I’m watching UYM for a long entry, but it really is way to early to commit to anything with real money. You may catch a falling knife and actually get lucky, but usually you won’t. Better to wait for some setups that make sense.

I looked at literally hundreds off charts tonight and everything is fairly hideous, but they always look like that before the massive nosebleed rally that always comes. Stocks like DLTR have weathered this storm well, and could indeed be a leader when things turn back up.

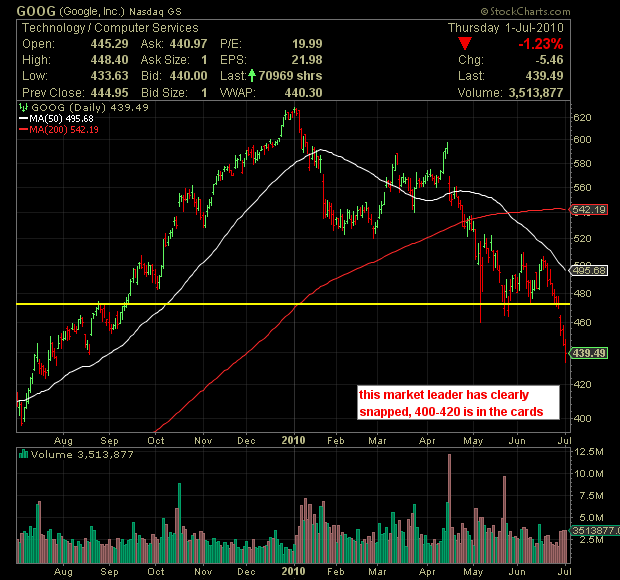

Market leaders like GOGG and AAPL are being taken to the woodshed.

940-980 S&P could be in the cards , but not on this move, there will be a rally that will give folks the “warm and fuzzy” again, but in my opinion that will all it will be. But who cares what it does as long as we van make money from both side, long and short.

It should be a real blast as we head into the second half as Europe still struggles, we struggle, and the November elections will go front page around September 1, maybe August. Tax cuts (or the expiration of them) will also play although much of that is discounted in.

Gold was interesting today as it broke a very long uptrend. It is now below the 50 day moving average and many believe that gold was being sold to meet margin calls by the risk managers at major hedge funds, also the “long” gold “short “Euro” may have seen a bit of an unwind today, the Euro has rebounded nicely.

Below are a few charts, no recommendations, just an observation. Jobs tomorrow, we’ll see how much a lousy number is baked in, should be a blast, see you in the morning.