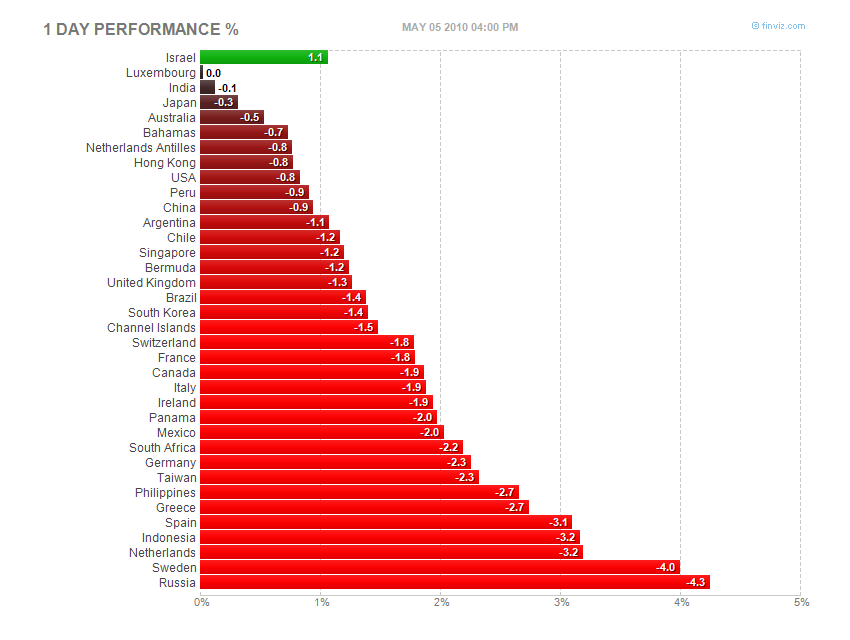

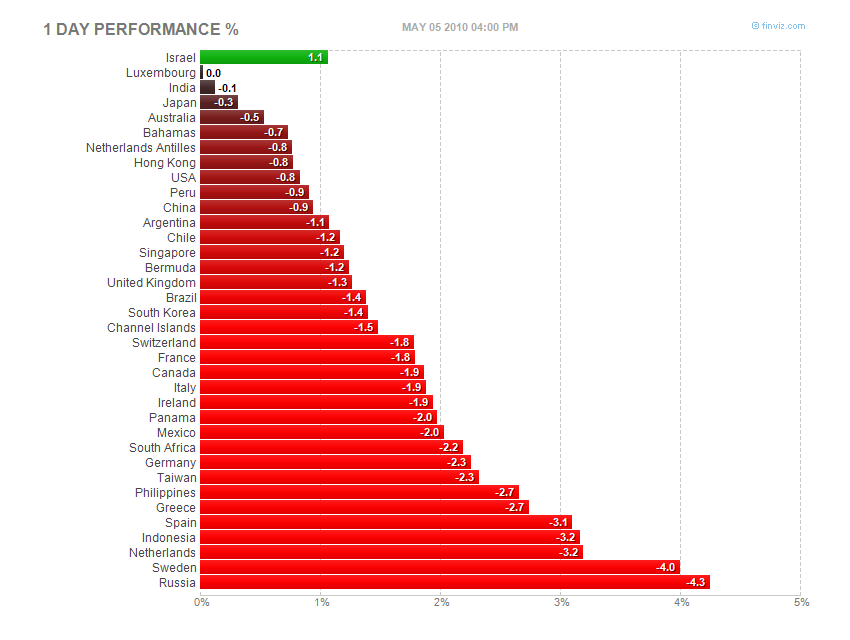

Yesterday was another lovely day as world markets finally figured out what contagion really means. Prime ministers and President’s from all parts of the globe opined on their immunity to the gripping fear that is Greece. Spain and Portugal sang the same song a few months ago (and every day since), and were kicked to the curb by the idiot savants at Moody’s, Fitch and S&P. Hey, even Goldman got put on “negative watch” by Fitch yesterday.

It’s a headline market right now, and CNBC shines in all its glory with repeated video of the same Greek protester screaming at the same cop outside the Acropolis. It’s drama, but not quality reporting and not even close to journalism, but Herrera is such a looker. I think Ron Insana is cold calling for a boiler room somewhere in Hackensack now. Phenomenal theater though for Joe Sixpack as he does a run on his bank and duct tapes his windows shut from pure fear. Well done CNBC. You so lack skill.

MSFT takes aim at GOOG and AAPL today with their new “Kin” phone. Softee couldn’t take aim at the side of a barn these days. It’s aimed at the younger crowd and the plan is to get teens addicted to the MSFT ecosystem, Facebook capability, etc…The phone looks like a Blackberry and has Zune capability. Laughing now. I know Steve Jobs is trembling.

Yesterday was another great day on the site with shorts in AXP and longs in CLF. We had one stop for less than a 2% loss.

Good luck today.

Wednesday, May 05, 2010

Economic

07:30 April Challenger Job Cuts

08:15 April ADP Employment Change

08:30 Chile March Economic Activity

10:00 April ISM Non-Manufacturing

10:30 DoE Crude Oil/Gasoline/Distillate Inventories

20:00 Colombia April Consumer Price Index

Events

08:30 Fed’s Rosengren speaks on housing in Boston. 10:10 Fed’s Lacker to speak to International Group in Richmond. 19:00 Fed’s Rosengren Speaks in New York. Same-store sales after the close. Morgan Stanley Payments Summit. STT Investor Day. 07:00 MBA Mortgage Applications. Trades Ex-dividend: AMP $0.18, ARLP $0.79, BEC $0.18, CMS $0.15, COST $0.205, EQT $0.22, FII $0.24, FE $0.55, INTC $0.158, LAZ $0.125, NSC $0.34, PLL $0.16, PFE $0.18, BA $0.42.

Earnings

Before the Open: AGU, AYR, AYE, ANR, AEE, ATRO, AAWW, FLY, LSE, CBZ, CNP, CTL, CBR, CLH, CGX, CTB, COT, DWSN, DVN, DGIT, ENB, FWLT, FCN, GRMN, IT, INSP, ICE, KCP, KNOL, ID, LNCE, LINC, LOJN, MED, MITI, MINI, TNDM, NEWS, NJR, NWN, OIIM, OWW, PKD, HK, PQ, POL, POWL, PGN, PEG, PHM, PWR, Q, RRD, SBGI, SIRO, SEP, TRK, SPW, TLM, NGLS, TGH, TWX, GTS, TRW, UPL, VSH, WBC, WCG, WMB. After the Close: ADCT, ABCO, ALTH, AEL, AFG, NLY, ATO, BGCP, BBBB, BMC, SAM, CELL, CECO, CBEY, CBS, CHDN, CLWR, CNL, COGT, VALE, CXO, CLR, CNW, CPA, CXW, CCRN, TRAK, DXCM, DSCM, ECHO, EDMC, EBS, ENOC, EQY, ERES, ESS, EXM, EXLS, EXPD, FARO, FFG, FLS, GCA, GLBL, GMXR, GDP, HAIN, HNSN, HIL, HIMX, HYC, NSIT, TEG, VTIV, JAZZ, JDSU, KAR, KNDL, KIM, KRG, LPSN, MTZ, MDTH, MOH, MUR, NRP, NCIT, NVEC, ONNN, OSUR, OEH, ORA, PACR, PVA, PNSN, PAA, PPO, PRA, PRO, PL, PRSC, PRU, QLTY, QSFT, REG, SONE, SWM, SENO, SMSI, STAN, SYMC, TTEC, TSCM, RIG, UNTD, VIRL, VTAL, WES, WGL.