{+++}I wanted to get a video out tonight but I am having challenges with Camtasia, my video provider. I am trying to fix it and will take another shot later if I can fix it.

The market was heavy today and could not hold the bid. The XLF looks especially weak and gave back much of the recovery rally that we saw on Friday.

The dollar rallied a bit and the daily chart looks very bullish, not good for commodities, Russia(RSX) which is helpless without strong ooil prices looks on the verge of a breakdown.

EWZ,EWP, EWG AND EWJ all look soft and ready to break lower.

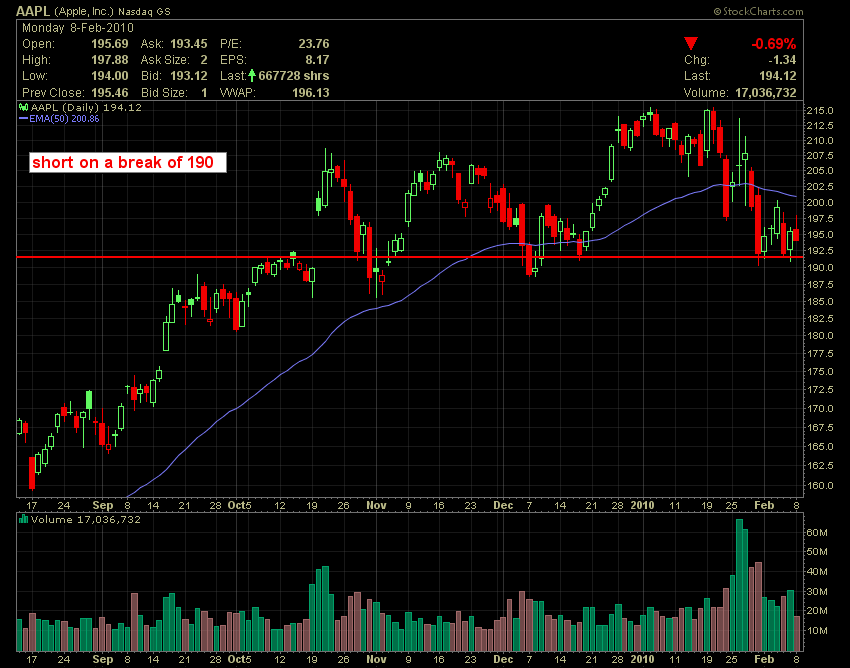

If you ask yourself what sector would be most impacted by a potential “fail” in Europe, the answer is the financials, not Apple or Amazon, although their charts look horrible too. I may add AAPL as a short soon.

WFC is rolling over and we are still short a half position. COH and JCG are weak and I think retail (RTH) will be a sector to watch on the downside.

Materials and oil tried a rally earlier in the day, but when the dollar rallied they sold off hard. Another case of good breadth to the downside, nothing is immune. I would have been very bullish on today if we had not seen that oversold technical bounce on Friday, because I think the easy long money was made after 3PM on Friday.

Things are very fragile here and I don’t think the smart money trusts that any good news will come out of the G-20, The World Bank or the IMF. Price usually tells the story.

If there is any kind of default out of Europe look for the S&P to trade to 950-1000, if good news comes out we will obviously rally higher, maybe to 1120. That’s what I see, you may see things differently.

I’m not really on the bull or bear side here, I just want to be on the “right” side.

Update: Short more JCG on a break of 37