{+++}

Trading volumes and data were light this week as markets wound down ahead of the holidays. In the US, the November housing starts and building permits data bounced back from the softness seen in October. The FOMC kept interest rates on hold and slightly sweetened its economic outlook, although this positive note was somewhat offset by the second consecutive increase in weekly jobless claims. The dollar gained steadily for a second week against the euro and the yen as sovereign debt issues continued to roil the Euro Zone, while gold hit a one month low below $1,100 on Thursday. The Senate Banking Committee voted to move the nomination of Fed Chairman Bernanke to a full Senate vote, but not without another round of Bernanke bashing from the usual quarters (even after Time named Bernanke the Man of the Year). In the background, there were dark rumblings: PIMCO’s Bill Gross raised his cash holdings to the highest level since the failure of Lehman in Sept 2008, while BoA/Merrill Lynch analysts discussed the possibility of a “Valentine’s day massacre” market correction in Q1 that could stem from the end of the Treasury’s MBS buying program or other factors, and Meredith Whitney took another swipe at banks, cutting her 2009-2011 EPS targets on JP Morgan, Goldman and Morgan Stanley. US equity markets closed the week out on high volume due to quadruple witching and the quarterly Q&P rebalancing. Equity indices ended mixed for the week, with the DJIA down 1.3%, the Nasdaq rising 1%, and the S&P 500 slipping 0.4%.

Citigroup has wasted no time in scaring up the capital it needs to pay back the US Treasury. The bank said on Monday that it would sell more than 20B in debt and equity to repay a portion of its TARP funds, and had priced a 5.4B share offering at $3.15/share by Thursday morning. Wells Fargo was right behind Citi, announcing later on Monday that it would repay its entire TARP stake. It priced an offering of 426M shares at $25/share. Note that a number of regional banks have not disclosed any plans for repaying TARP as of yet and have lost ground this week, including SunTrust and Fifth Third Bank. Meredith Whitney was out this week ripping the more solvent end of the industry, cutting her earnings estimates on Goldman Sachs, Morgan Stanley and JP Morgan well below the consensus.

Strong earnings from selected tech names helped the NASDAQ outperform the Dow and S&P500 this week. Adobe, Oracle and Research in Motion reported better than expected quarterly results and offered strong forward-looking guidance. RIMM’s shipment volume grew more than 20% sequentially and new subscribers were up by more than 12% q/q. Intel took a hit this week when the FTC sued the company for using its dominant market position for a decade to stifle competition and strengthen its monopoly.

Trading in US Treasuries revolved around the FOMC statement this week. The yield curve hit fresh steepening highs post FOMC, with 2 10-year spread getting as wide as 278bps. Yields have traded in a fairly wide range over the course of the week, the benchmark 10y Note ascended though 3.60% for the first time since late summer, only to retreat to more respectable levels holding near 3.5% as the week drew to a close.

The Greek fiscal tragedy took more twists and turns this week. The government announced a number of ambitious debt and deficit reduction targets early on while the finance minister embarked upon a confidence building tour of Europe’s major financial centers. But in the absence of any specifics bond markets and rating agencies remain unconvinced. S&P joined Fitch in downgrading the Hellenic Republic to BBB+ on Wednesday. The downgrade leaves Moody’s flying solo with an A1 rating two notches above its peers. Should Moody’s choose to recalibrate its rating to be closer to the other agencies, Greek government bonds would be ineligible collateral for ECB liquidity operations (if and when it decides to return to pre crisis rules) which would likely set off a chain reaction of issues for Greek banks. The government in Greece is dirtier than that of New Jersey so good luck.

The technical picture has been constructive for the dollar, with 200-day moving averages were back on the radar, particularly against the European pairs. The FOMC statement only sustained the dollar’s momentum, with the Fed offering a slightly more optimistic economic outlook.

My current holdings look like this Long-: AAPL, JPM and JPM warrants, SEED.

Shorts: STI,WFC, XHB, ABAX

I warned you about XLF last week, be real careful there, $14 as I mentioned is psychological support, it came within a penny of breaking on Friday before they turned and mustered a rally, next stop would be around 13.75. A lot depends on the TARP babies holding their secondary prices,WFC,BAC and C. I will bail out on my JPM long if XLF fails.

The materials, metals and mining may catch an oversold bounce this week as they are a bit short term oversold. If the dollar can retrace a bit (bounce), there will be some nice long side plays there. Watch XME,XLB and UYM.

ABAX finally snapped a bit on good volume Friday, so keep an eye on it. I changed the trigger on XHB and moved the stop on ASIA. VNO hanging in fine and GT is fine.

Here are two shorts and a long for the week ahead. Like Thanksgiving week you can plan on some volatility I think. Let’s get ready for 2010!!!

| Date | Symbol | Long Price | Short Price | Stop | Action | Result P/(L) | Triggered |

| 9-24-09 | |||||||

| MCO | 23.00 | 22.00 | Covered 1/3

Covered 1/3 Stopped 1/3 |

+2.00

+4.30 +1.00 |

yes | ||

| MHP | 26.19 | 26 | Covered ½,stopped on balance flat | +2.00 | yes | ||

| NAV | 40.31 | 39 | Covered 1/3

Covered 1/3 Covered 1/3 |

+1.30

+3.00 +2.03 |

yes | ||

| QSFT | 16.30 | 16 | Sold ½, sold balance(10-13-9) | +.80

+1.70 |

yes | ||

| SIGA | 8.43 | 7.65 | Stopped | -.80 | yes | ||

| MELA | 10.50 | 9.50 | Stopped | -1.00 | yes | ||

| 9-28-09 | COCO | 17.29 | 18.25 | Sold ½

Stopped 1/2 |

+1.00

-.90 |

yes | |

| ZION | 17.39 | 19.00 | Stopped ½ flat | yes | |||

| 9-30-09 | YGE | 11.90 | 12.60 | -.70 | yes | ||

| VNO | 63.00 | 65.50 | flat | +2.50 | yes | ||

| XCO | 19.05 | 18.00 | stopped | -1.05 | yes | ||

| MHGC | 5.60 | 5.20 | -.40 | yes | |||

| 10-1-09 | CALI | 6.35 | 5.50 | stopped | -.85 | no | |

| CENX | 8.97 | 9.60 | stopped | +.50 | yes | ||

| BAC | 16.02 | 16.80 | stopped | -.78 | yes | ||

| AAP | 37.70 | 39.40 | stopped | -1.70 | yes | ||

| 10-05-09 | EXC | 47.78 | 50 | stopped | -2..22 | yes | |

| JEF | 27.60 | 27.90 | Sold 100% (10-13-9) | +1.60 | yes | ||

| TSPT | 14.35 | 13.70 | stopped | -.65 | yes | ||

| HIG | 29.05 | 28.30 | stopped | -.75 | yes | ||

| APT | 6.25 | 6.00 | stopped | -.25 | yes | ||

| 10-7-9 | FCX | 73.43 | 73.00 | Sold half(10-13-9)

Sold balance10-14-9 |

+1.78

+3.10 |

yes | |

| 10-10-9 | PENN | 25.67 | 26.20 | stopped | -.53 | yes | |

| NITE | 23.00 | 22.40 | stopped | -.60 | yes | ||

| O | 22.85 | 24.00 | yes | ||||

| STEC | 25.51 | 25.80 | Covered 1/3

Covered 2/3 |

+1.00

+3.50 |

yes | ||

| ARST | 23.59 | 24.00 | Sold 1/3

Sold 1/3 |

+1.20

+2.20 |

yes | ||

| FIRE | 23.43 | 22.50 | stopped | -1.90 | yes | ||

| 10-14-9 | HRBN | 19.72 | 19.30 | stopped | -.50 | yes | |

| UCTT | 6.95 | 6.30 | stopped | -.65 | yes | ||

| 10-15-09 | MS | 33.35 | 33.00 | Sold all | +2.00 | ||

| 10-16-9 | QSII | 65.76 | 64.00 | stopped | -1.76 | yes | |

| ACI | 24.22 | 23.20 | stopped | -1.02 | yes | ||

| 10-19-9 | MEE | 33.64 | 34.50 | stopped | -1.20 | yes | |

| BTU | 42.35 | 42.50 | sold | +.20 | yes | ||

| FSLR | 146.80 | 152 | stopped | -5.00 | yes | ||

| ABAX | 23.86 | 25.00 | Covered ½

Covered 1/2 |

+1.00

+1.00 |

yes | ||

| PPD | 40.12 | 41.50 | Stopped | -1.30 | yes | ||

| MCO | 23.14 | 25.50 | Stopped | -2.35 | yes | ||

| 10-22-9 | MCRS | 27.40 | 28.00 | Covered 1/3 | +1.30 | yes | |

| AMAG | 35.10 | 35.90 | yes | ||||

| TNDM | 22.92 | 23.40 | Covered ½

Covered ¼ Stopped 1/4 |

+1.90

+2.30 -.48 |

yes | ||

| BAC | 16.05 | 16.60 | Covered 1/3

Covered 1/3 Covered 1/3 |

+.80

+1.00 +1.50 |

yes | ||

| VMI | 75.70 | 76.70 | Covered ½

Covered ¼ Covered balance |

+3.00

+3.00 +4.00 |

yes | ||

| CMG | 81.13 | 83.00 | Stopped | -1.87 | yes | ||

| ROVI | 28,09 | 29.00 | Stopped | -.91 | yes | ||

| CCL | 30.60 | 31.60 | Covered 1/3 | +1.30 | yes | ||

| 10-30-9 | RTH | 90.00 | 92.00 | Stopped | -2.00 | yes | |

| ROST | 43.76 | 44.83 | Stopped | -1.10 | yes | ||

| NIHD | 27.25 | 28.25 | Covered ½

Stopped 1/2 |

+1.90

-1.00 |

yes | ||

| FWLT | 28.12 | 29.00 | Stopped | -.88 | yes | ||

| 11-2-09 | CYOU | 29.00 | 29.80 | Stopped | .-80 | yes | |

| YGE | 11.17 | 11.70 | Stopped | -50 | yes | ||

| JLL | 46.38 | 47.20 | Sold ½

Stopped 1/2 |

+1.30

-82 |

yes | ||

| XHB | 13.70 | 14.30 | Stopped | -.60 | yes | ||

| WFC | 27.40 | 28.20 | Stopped | -80 | yes | ||

| 11-5-09 | FUQI | 19.14 | 21.00 | Stopped | -1.86 | yes | |

| CMG | 87.50 | 89.50 | Stopped | -2.00 | yes | ||

| EXPE | 23.60 | 24.70 | Stopped | -1.10 | yes | ||

| AIG | 32.66 | 31.00 | Sold 1/3

Stopped 2/3 |

+4.00

+1.66 |

yes | ||

| MEE | 33.68 | 32.00 | Sold | +3.60 | yes | ||

| BEC | 65.50 | 68.50 | Stopped | -3.00 | yes | ||

| 11-13-09 | GT | 14.56 | 15.50 | yes | |||

| 11-18-09 | FCX | 85.20 | 81.75 | Stopped | -3.30 | yes | |

| AGU | 55.80 | 55.50 | Stopped | -1.80 | yes | ||

| 11-19-09 | TSTC | 13.80 | 15.00 | Sold 2/3 on 12.2.9 | +2.50 | yes | |

| 11-20-09 | ABAX | 22.30 | 24.75 | yes | |||

| 11-23-09 | POT | 115.53 | 111.50 | stopped | -4.00 | yes | |

| MOS | 55.40 | 55.00 | Sold 12/2.9 | +4.90 | yes | ||

| 12/3/09 | VISN | 10.46 | 10.00 | yes | |||

| 12/6/09 | WFC | 26.00 | 27.25 | yes | |||

| 12/8/09 | NANO | 13.40 | 11.40 | yes | |||

| 12/9/09 | XTO | 40.20 | 43.50 | Stopped-Takeover | -7.00 | yes | |

| APA | 91.90 | 96.00 | Stopped | -4.10 | yes | ||

| UPL | 44.92 | 48.00 | Stopped | -3.00 | yes | ||

| EOG | 84.95 | 89.00 | Stopped | -4.00 | yes | ||

| PNC | 52.00 | 55.00 | no | ||||

| 12/10/9 | XHB | 14.69 | 15.00 | no | |||

| ASIA | 31.15 | 28.50 | yes | ||||

| SEED | 11.50 | 10.00 | yes | ||||

| 12/14/09 | VNO | 70.56 | 67.70 | yes | |||

| 12/21/09 | PRGO | 30.75 | 33.00 | no | |||

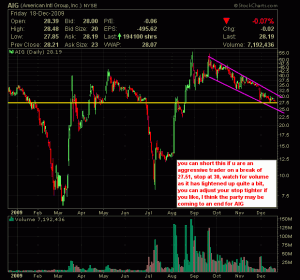

| AIG | 27.51 | 30-31 | no | ||||

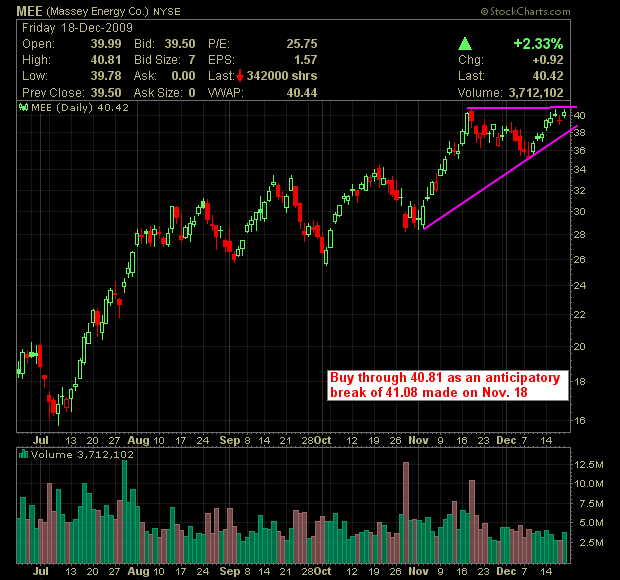

| MEE | 40.81 | 39.00 |