{+++}

Global markets began the week with a Dubai debt hangover, and the accompanying risk aversion had its usual effect on equities, debt and FX. On Tuesday markets rebounded in Asia, Europe and the US, with gains aided by better than expected US October pending home sales and construction spending data.

Friday’s employment data provided the sort of material improvement that investors have been waiting for. November non-farm payrolls data was an order of magnitude lower than consensus estimates and crept tantalizingly close to positive growth, while the November unemployment rate fell to 10%. The employment picture was complemented by gains in wages and hours worked. Administration officials tried to tamp down expectations after the data while many other commentators reiterated that job growth, when it arrives, would likely be anemic. Credit Suisse’s chief economist said the jobs data were likely a “rogue” positive blip, a common occurrence ahead of the trough, affirming his expectation that the bottom for the US labor market won’t arrive until February or March.

Bank of America took a big step toward normalcy this week, selling $19B in common equity as part of its plan to buy back warrants from the US Treasury and pay back its $45B in TARP funds. The pricing and sale went off without a hitch, and shares of BAC were up 5% or so on the week, leading the US banking sector higher. This leaves Citigroup, Wells Fargo, and PNC as the last leading banks in which the government holds a large stake.

November same-store sales were broadly worse than expected. The International Council of Shopping Centers (ICSC), which tracks chain store sales, reported that November results were “disappointing,” coming in at -0.3% y/y, compared to its expectation of +3-4%.

Gold continued to hit fresh all-time highs on speculation that China’s demand for the precious metal is growing. A London Times article noted that China will likely become the world’s biggest gold consumer, vaulting ahead of India. Demand in 2008 was 395.6 tons, said senior figures in the China Gold Association, but the total figure by the end of 2009 could be well over the 450-ton mark.

The week ahead will be interesting and certainly will be filled with more twists and turns. What will the dollar do? Will it fade after its huge move on Monday or will the rally continue and put more pressure on materials, gold and commodities? Still too early to tell, but we may know more as soon as tomorrow. The dollar staying in the $74-76 range makes for great trsding in stocks, but a break above or below those levels will pose a problem for equity longs.

Oil has been quiet and seems to be forming a constructive base and I’m watching for an opportunity there from the long side.

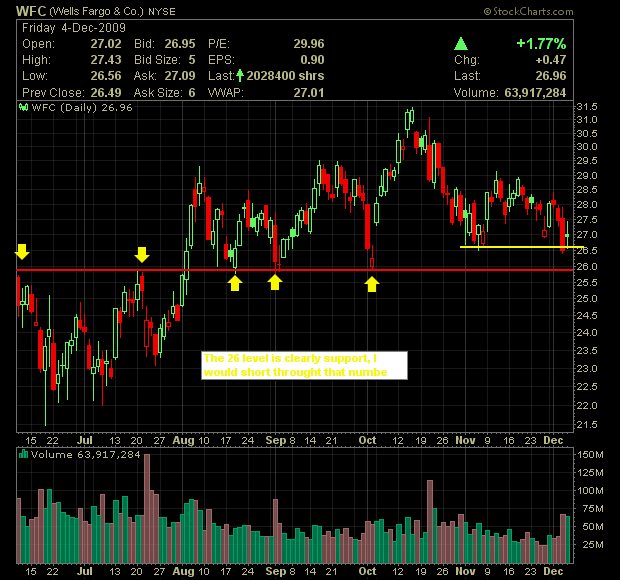

The financials bounced Friday after the horrible showing they put in on Friday and the volume on the XLF was big, don’t get too excited it was mainly because of Bank of America and the billion shares that stock traded. The chart on WFC by the way looks ready to break if you ask me. PNC also looks troubling.

Some things to consider here before we get all misty eyed:

Brown shoot? The ISM non-manufacturing index falls below the 50-mark in November

• Not normal — in the U.S., stocks, gold, oil, and bond prices have all risen at the same time; in the past, this is a rare occurrence — 1-in-15 event

• U.S. jobless claims — initial jobless claims are falling; however, what continues to be disturbing is the increase in the number of people receiving emergency benefits

• Taking the sails out sales — fully 75% of retailers missed their sales target in November.

The S&P is doing its best to break out, and maybe it will, but the possibility of a failure around these levels is enormous, hence extreme caution is warranted. I usually like to see how Monday plays out and get the “mood” of the market so to speak, so I don’t have many names at all tonight. We were stopped last week on FCX and AGU, I evidently missed (AGU) as it happened on that wacky low volume half day Dubai Friday.

The dollar roared on Friday, if that trend continues stocks and especially materials and commodities will be in trouble. It is still too early to tell, but if it does continue, these names that have been winners (materials) will turn in to shorts in a hurry. Jury still out for now. Don’t forget those right shoulders that are developing on XME and XLB.

Hope you had a great weekend, and your comments are always welcome.

| Date | Symbol | Long Price | Short Price | Stop | Action | Result P/(L) | Triggered |

| 9-24-09 | |||||||

| MCO | 23.00 | 22.00 | Covered 1/3

Covered 1/3 Stopped 1/3 |

+2.00

+4.30 +1.00 |

yes | ||

| MHP | 26.19 | 26 | Covered ½,stopped on balance flat | +2.00 | yes | ||

| NAV | 40.31 | 39 | Covered 1/3

Covered 1/3 Covered 1/3 |

+1.30

+3.00 +2.03 |

yes | ||

| QSFT | 16.30 | 16 | Sold ½, sold balance(10-13-9) | +.80

+1.70 |

yes | ||

| SIGA | 8.43 | 7.65 | Stopped | -.80 | yes | ||

| MELA | 10.50 | 9.50 | Stopped | -1.00 | yes | ||

| 9-28-09 | COCO | 17.29 | 18.25 | Sold ½

Stopped 1/2 |

+1.00

-.90 |

yes | |

| ZION | 17.39 | 19.00 | Stopped ½ flat | yes | |||

| 9-30-09 | YGE | 11.90 | 12.60 | -.70 | yes | ||

| VNO | 63.00 | 65.50 | flat | yes | |||

| XCO | 19.05 | 18.00 | stopped | -1.05 | yes | ||

| MHGC | 5.60 | 5.20 | -.40 | yes | |||

| 10-1-09 | CALI | 6.35 | 5.50 | stopped | -.85 | no | |

| CENX | 8.97 | 9.60 | stopped | +.50 | yes | ||

| BAC | 16.02 | 16.80 | stopped | -.78 | yes | ||

| AAP | 37.70 | 39.40 | stopped | -1.70 | yes | ||

| 10-05-09 | EXC | 47.78 | 50 | stopped | -2..22 | yes | |

| JEF | 27.60 | 27.90 | Sold 100% (10-13-9) | +1.60 | yes | ||

| TSPT | 14.35 | 13.70 | stopped | -.65 | yes | ||

| HIG | 29.05 | 28.30 | stopped | -.75 | yes | ||

| APT | 6.25 | 6.00 | stopped | -.25 | yes | ||

| 10-7-9 | FCX | 73.43 | 73.00 | Sold half(10-13-9)

Sold balance10-14-9 |

+1.78

+3.10 |

yes | |

| 10-10-9 | PENN | 25.67 | 26.20 | stopped | -.53 | yes | |

| NITE | 23.00 | 22.40 | stopped | -.60 | yes | ||

| O | 22.85 | 24.00 | yes | ||||

| STEC | 25.51 | 25.80 | Covered 1/3

Covered 2/3 |

+1.00

+3.50 |

yes | ||

| ARST | 23.59 | 24.00 | Sold 1/3

Sold 1/3 |

+1.20

+2.20 |

yes | ||

| FIRE | 23.43 | 22.50 | stopped | -1.90 | yes | ||

| 10-14-9 | HRBN | 19.72 | 19.30 | stopped | -.50 | yes | |

| UCTT | 6.95 | 6.30 | stopped | -.65 | yes | ||

| 10-15-09 | MS | 33.35 | 33.00 | Sold all | +2.00 | ||

| 10-16-9 | QSII | 65.76 | 64.00 | stopped | -1.76 | yes | |

| ACI | 24.22 | 23.20 | stopped | -1.02 | yes | ||

| 10-19-9 | MEE | 33.64 | 34.50 | stopped | -1.20 | yes | |

| BTU | 42.35 | 42.50 | sold | +.20 | yes | ||

| FSLR | 146.80 | 152 | stopped | -5.00 | yes | ||

| ABAX | 23.86 | 25.00 | Covered ½

Covered 1/2 |

+1.00

+1.00 |

yes | ||

| PPD | 40.12 | 41.50 | Stopped | -1.30 | yes | ||

| MCO | 23.14 | 25.50 | yes | ||||

| 10-22-9 | MCRS | 27.40 | 28.00 | Covered 1/3 | +1.30 | yes | |

| AMAG | 35.10 | 35.90 | yes | ||||

| TNDM | 22.92 | 23.40 | Covered ½

Covered ¼ Stopped 1/4 |

+1.90

+2.30 -.48 |

yes | ||

| BAC | 16.05 | 16.60 | Covered 1/3

Covered 1/3 Covered 1/3 |

+.80

+1.00 +1.50 |

yes | ||

| VMI | 75.70 | 76.70 | Covered ½

Covered ¼ Covered balance |

+3.00

+3.00 +4.00 |

yes | ||

| CMG | 81.13 | 83.00 | Stopped | -1.87 | yes | ||

| ROVI | 28,09 | 29.00 | Stopped | -.91 | yes | ||

| CCL | 30.60 | 31.60 | Covered 1/3 | +1.30 | yes | ||

| 10-30-9 | RTH | 90.00 | 92.00 | Stopped | -2.00 | yes | |

| ROST | 43.76 | 44.83 | Stopped | -1.10 | yes | ||

| NIHD | 27.25 | 28.25 | Covered ½

Stopped 1/2 |

+1.90

-1.00 |

yes | ||

| FWLT | 28.12 | 29.00 | Stopped | -.88 | yes | ||

| 11-2-09 | CYOU | 29.00 | 29.80 | Stopped | .-80 | yes | |

| YGE | 11.17 | 11.70 | Stopped | -50 | yes | ||

| JLL | 46.38 | 47.20 | Sold ½

Stopped 1/2 |

+1.30

-82 |

yes | ||

| XHB | 13.70 | 14.30 | Stopped | -.60 | yes | ||

| WFC | 27.40 | 28.20 | Stopped | -80 | yes | ||

| 11-5-09 | FUQI | 19.14 | 21.00 | Stopped | -1.86 | yes | |

| CMG | 87.50 | 89.50 | Stopped | -2.00 | yes | ||

| EXPE | 23.60 | 24.70 | Stopped | -1.10 | yes | ||

| AIG | 32.66 | 31.00 | Sold 1/3

Stopped 2/3 |

+4.00

+1.66 |

yes | ||

| MEE | 33.68 | 32.00 | Sold | +3.60 | yes | ||

| BEC | 65.50 | 68.50 | yes | ||||

| 11-13-09 | GT | 14.56 | 15.50 | yes | |||

| 11-18-09 | FCX | 85.20 | 81.75 | yes | |||

| AGU | 55.80 | 55.50 | Stopped | -1.80 | yes | ||

| 11-19-09 | TSTC | 13.80 | 15.00 | Sold 2/3 on 12.2.9 | +2.50 | yes | |

| 11-20-09 | ABAX | 22.30 | 24.30 | yes | |||

| 11-23-09 | POT | 115.53 | 111.50 | stopped | -4.00 | yes | |

| MOS | 55.40 | 55.00 | Sold 12/2.9 | +4.90 | yes | ||

| 12/3/09 | VISN | 10.46 | 10.00 | yes | |||

| 12/4/09 | NAV | 31.53 | 32.50 | no | |||

| 12/6/09 | WFC | 26.00 | 28.00 | no |