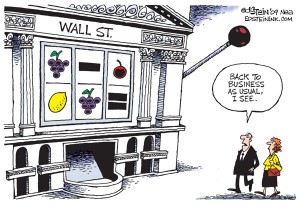

The underlying strength that the materials and oil sector showed yesterday was quite impressive, especially in the face of a very strong dollar rebound. The carry trade is in full swing and unbridled enthusiasm is all the rage. Corporate America is addicted to cheap rates and our politicos are as dovish as all get out on both rates and the dollar. Do we really have to keep rates at a 1/4? Would things be really much worse off at 1/2 or 3/4? Probably not, but optically and psychologically it would be devastating. Perception is reality.

The underlying strength that the materials and oil sector showed yesterday was quite impressive, especially in the face of a very strong dollar rebound. The carry trade is in full swing and unbridled enthusiasm is all the rage. Corporate America is addicted to cheap rates and our politicos are as dovish as all get out on both rates and the dollar. Do we really have to keep rates at a 1/4? Would things be really much worse off at 1/2 or 3/4? Probably not, but optically and psychologically it would be devastating. Perception is reality.

So for now the beat goes on and if you aren’t long commodities and materials your missing the boat. We’ve closed over 1100 for two days in a row. Perhaps the dollar bears bid up those sectors yesterday because they viewed the bump in the greenback yesterday as a one day wonder.

Yesterday Blankfein apologized for being rich and doing “bad” things (GS) so now he and Buffet (willing co-conspirator) have decided to give back to small businesses. Thanks for that Lloyd, you’re swell. Don’t get be wrong I love GS and love the free market more than anyone, I just marvel at the incestuous triad of Warren, Lloyd and Timmy. What a great book it would be, but no one will be allowed to write it.

Around the Horn:

China asks Obama how he plans to pay for healthcare

RIMM catches a downgrade

Mortgage apps fall to 12 year low

Bartiromo starts a newsletter

Creditors takeover Trump casinos