{+++}It was an awful week for the bulls and it is starting to look really good for us, assuming the bears can follow through in the coming week. Bearish charts are popping up and they are becoming easier to read as set ups for high probability trades. Let’s not get cocky because we all know what happened on Thursday after the big down day on Wednesday. As usual, the market did the exact opposite of the dollar and that trend should continue…..until it doesn’t. I’ve tightened stops on our shorts for that very reason, knee jerk bounces can stop us, but it still pays to be cautious. Many of our shorts have triggered and have nice looking downside if the market cooperates.

Last week we discussed the volatility in U.S. equity markets, and that not only continued this week it became more aggressive. But unlike the prior week’s modest moves, the major averages closed sharply lower this week as the dollar rebounded against the other major currencies. The S&P 500 lost 4%.

Once again the declines were broad-based as all ten sectors in the index ended lower, led by Materials (-7.1%) and Financials (-6.9%).

The dollar was the biggest, if not the only, catalyst this week. In fact, the charts of the major indices are almost exact inverses of the U.S Dollar Index (DXY). The dreaded unemployment figures are announced on Friday and that will probably be the biggest data point of the week, along with Bernanke and the rate decision on Wednesday. I added a few more shorts as nothing looks good to me from the long side.

Let’s have a great week. MCO is already on our list but I am posting the chart again as it may be getting close to a breakdown.

Monday, November 02, 2009

| Date | Symbol | Long Price | Short Price | Stop | Action | Result P/(L) | Triggered |

| 9-24-09 | |||||||

| MCO | 23.00 | 22.00 | Covered 1/3

Covered 1/3 Stopped 1/3 |

+2.00

+4.30 +1.00 |

yes | ||

| MHP | 26.19 | 26 | Covered ½,stopped on balance flat | +2.00 | yes | ||

| NAV | 40.31 | 39 | Covered 1/3

Covered 1/3 Covered 1/3 |

+1.30

+3.00 +2.03 |

yes | ||

| QSFT | 16.30 | 16 | Sold ½, sold balance(10-13-9) | +.80

+1.70 |

yes | ||

| SIGA | 8.43 | 7.65 | Stopped | -.80 | yes | ||

| MELA | 10.50 | 9.50 | Stopped | -1.00 | yes | ||

| 9-28-09 | COCO | 17.29 | 18.25 | Sold ½

Stopped 1/2 |

+1.00

-.90 |

yes | |

| ZION | 17.39 | 19.00 | Stopped ½ flat | yes | |||

| 9-30-09 | YGE | 11.90 | 12.60 | -.70 | yes | ||

| VNO | 63.00 | 65.50 | flat | yes | |||

| XCO | 19.05 | 18.00 | stopped | -1.05 | yes | ||

| MHGC | 5.60 | 5.20 | -.40 | yes | |||

| 10-1-09 | CALI | 6.35 | 5.50 | stopped | -.85 | no | |

| CENX | 8.97 | 9.60 | stopped | +.50 | yes | ||

| BAC | 16.02 | 16.80 | stopped | -.78 | yes | ||

| AAP | 37.70 | 39.40 | stopped | -1.70 | yes | ||

| 10-05-09 | EXC | 47.78 | 50 | stopped | -2..22 | yes | |

| JEF | 27.60 | 27.90 | Sold 100% (10-13-9) | +1.60 | yes | ||

| TSPT | 14.35 | 13.70 | stopped | -.65 | yes | ||

| HIG | 29.05 | 28.30 | stopped | -.75 | yes | ||

| APT | 6.25 | 6.00 | stopped | -.25 | yes | ||

| 10-7-9 | FCX | 73.43 | 73.00 | Sold half(10-13-9)

Sold balance10-14-9 |

+1.78

+3.10 |

yes | |

| 10-10-9 | PENN | 25.67 | 26.20 | stopped | -.53 | yes | |

| NITE | 23.00 | 22.40 | stopped | -.60 | yes | ||

| O | 22.85 | 24.00 | yes | ||||

| STEC | 25.51 | 25.80 | Covered 1/3

Covered 2/3 |

+1.00

+3.50 |

yes | ||

| ARST | 23.59 | 24.00 | Sold 1/3

Sold 1/3 |

+1.20

+2.20 |

yes | ||

| FIRE | 23.43 | 22.50 | stopped | -1.90 | yes | ||

| 10-14-9 | HRBN | 19.72 | 19.30 | stopped | -.50 | yes | |

| UCTT | 6.95 | 6.30 | stopped | -.65 | yes | ||

| 10-15-09 | MS | 33.35 | 33.00 | Sold all | +2.00 | ||

| 10-16-9 | QSII | 65.76 | 64.00 | stopped | -1.76 | yes | |

| ACI | 24.22 | 23.20 | stopped | -1.02 | yes | ||

| 10-19-9 | MEE | 33.64 | 34.50 | stopped | -1.20 | yes | |

| BTU | 42.35 | 42.50 | sold | +.20 | yes | ||

| FSLR | 146.80 | 152 | stopped | -5.00 | yes | ||

| ABAX | 23.86 | 25.00 | Covered 1/2 | +1.00 | yes | ||

| PPD | 40.12 | 41.50 | yes | ||||

| MCO | 23.14 | 25.50 | no | ||||

| 10-22-9 | MCRS | 27.40 | 28.00 | yes | |||

| AMAG | 35.10 | 35.90 | yes | ||||

| TNDM | 22.92 | 23.40 | Covered 1/2 | +1.90 | yes | ||

| BAC | 16.05 | 16.60 | Covered 1/3

Covered 1/3 Covered 1/3 |

+.80

+1.00 +1.50 |

yes | ||

| VMI | 75.70 | 76.70 | Covered ½

Covered 1/4 |

+3.00

+3.00 |

yes | ||

| CMG | 81.13 | 83.00 | yes | ||||

| ROVI | 28,09 | 29.00 | yes | ||||

| CCL | 30.60 | 31.60 | Covered 1/3 | +1.30 | yes | ||

| 10-30-9 | RTH | 90.00 | 92.00 | yes | |||

| ROST | 43.76 | 44.83 | yes | ||||

| NIHD | 27.25 | 28.25 | yes | ||||

| FWLT | 28.12 | 29.00 | yes | ||||

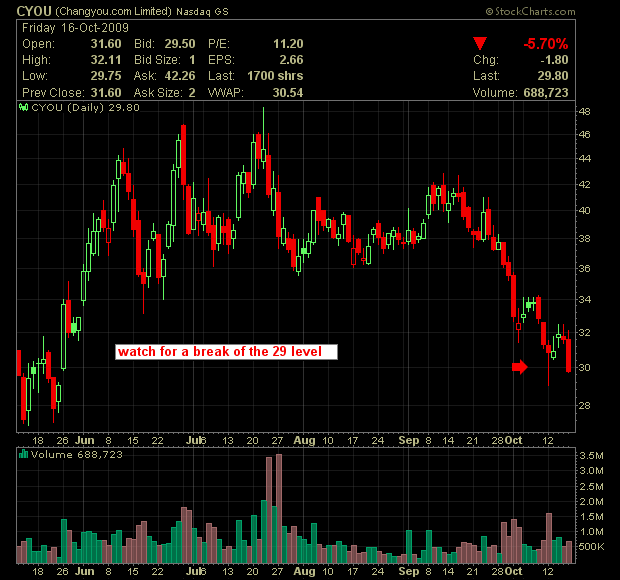

| 11-2-09 | CYOU | 29.00 | 29.80 | no | |||

| YGE | 11.17 | 11.70 | no | ||||

| JLL | 46.38 | 47.20 | no | ||||

| XHB | 13.70 | 14.30 | no | ||||

| WFC | 27.40 | 28.20 | no |