{+++}Last Friday morning I called for a possible top in the market. The jury is still out on that one as the bears could not break and hold under the 1080 level on the S&P. Intel has done nothing since the initial earnings euphoria, where’s the follow through? Goldman caved, IBM got hammered on a report that I thought was pretty good. JP Morgan was just eh, and Google did well. I’m just wondering if the market isn’t just saying “hey I’m exhausted and I really need a break.”

We are not even close to earnings being in full swing and we see Apple report after the close tomorrow, and names like WFC, MS and CAT are coming soon. The quality of earning so far remains poor, many upticks are due to cost cutting, firing and an outright cessation of spending, the bar is ridiculously low too.

The dollar in my opinion is in free fall and Geithner seems clueless and recently said “the dollar is fine and will remain the world’s leading currency.'” I guess he missed the headline that Iran wants to drop the dollar ASAP and Russia made similar comments last week. Many are looking for an additional 20% drop in the dollar. You know I’ve been saying for a few months now that if the dollar index breaks the $72 level we could see the market crash, not correct, but crash.

So what is the upside to all this? Well, we could see an epic continuation of the materials and commodity trade. Some will argue that it’s a crowded trade but they always stay much more crowded and run much longer than anyone ever thinks.

I have added some good looking longs and shorts for the week ahead. Please review them carefully. For the newbies please stay away from the first 15 minutes, especially the immediate opening bell.

Let’s have a fun and profitable week.

| Date | Symbol | Long Price | Short Price | Stop | Action | Result P/(L) | Triggered |

| 9-24-09 | |||||||

| MCO | 23.00 | 22.00 | Sold 1/3 sold 1/3 stopped 1/3 | +2.00

+4.30 +1.00 |

yes | ||

| MHP | 26.19 | 26 | Sold ½,stopped on balance flat | +2.00 | yes | ||

| NAV | 40.31 | 39 | Sold 1/3, Sold 1/3

Sold 1/3 |

+1.30

+3.00 +2.03 |

yes | ||

| QSFT | 16.30 | 16 | Sold ½, sold balance(10-13-9) | +.80

+1.70 |

yes | ||

| SIGA | 8.43 | 7.65 | -.80 | yes | |||

| MELA | 10.50 | 9.50 | -1.00 | yes | |||

| 9-28-09 | COCO | 17.29 | 18.25 | Sold ½

Stopped 1/2 |

+1.00

-.90 |

yes | |

| ZION | 17.39 | 19.00 | Stopped ½ flat | yes | |||

| 9-30-09 | YGE | 11.90 | 12.60 | -.70 | yes | ||

| VNO | 63.00 | 65.50 | flat | yes | |||

| XCO | 19.05 | 18.00 | stopped | -1.05 | yes | ||

| MHGC | 5.60 | 5.20 | -.40 | yes | |||

| 10-1-09 | CALI | 6.35 | 5.50 | no | |||

| CENX | 8.97 | 9.60 | stopped | +.50 | yes | ||

| BAC | 16.02 | 16.80 | stopped | -.78 | yes | ||

| AAP | 37.70 | 39.40 | stopped | -1.70 | yes | ||

| 10-05-09 | EXC | 47.78 | 50 | stopped | -2..22 | yes | |

| JEF | 27.60 | 27.90 | Sold 100% (10-13-9) | +1.60 | yes | ||

| TSPT | 14.35 | 13.50 | yes | ||||

| HIG | 29.05 | 28.30 | stopped | -.75 | yes | ||

| APT | 6.25 | 6.00 | -.25 | yes | |||

| 10-7-9 | FCX | 73.43 | 73.00 | Sold half(10-13-9)

Sold balance10-14-9 |

+1.78

+3.10 |

yes | |

| 10-10-9 | PENN | 25.67 | 26.20 | yes | |||

| NITE | 23.00 | 22.40 | stopped | -.60 | yes | ||

| O | 22.85 | 24.60 | no | ||||

| STEC | 25.51 | 27.40 | Covered 1/3 | +1.00 | yes | ||

| ARST | 23.59 | 21.50 | Sold 1/3,sold 1/3 | +1.20

+2.20 |

yes | ||

| FIRE | 23.43 | 22.50 | yes | ||||

| 10-14-9 | HRBN | 19.72 | 18.90 | yes | |||

| UCTT | 6.95 | 6.30 | stopped | -.65 | yes | ||

| 10-15-09 | MS | 33.35 | 31.50 | ||||

| 10-16-9 | QSII | 65.76 | 64.00 | no | |||

| ACI | 24.22 | 23.50 | yes | ||||

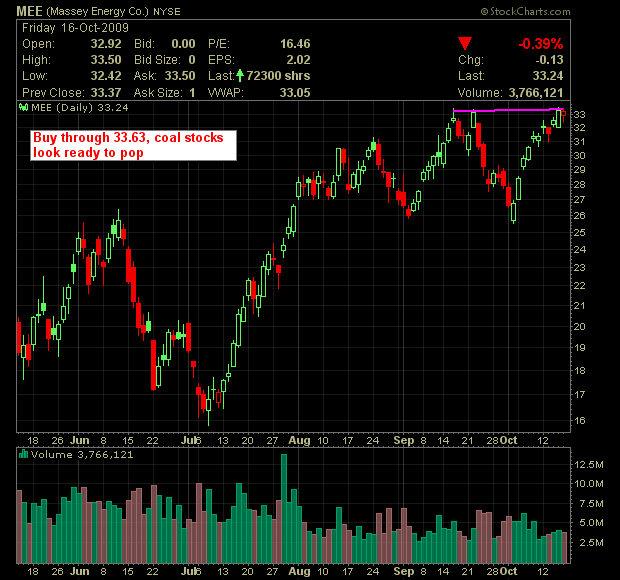

| 10-19-9 | MEE | 33.64 | 32.40 | no | |||

| BTU | 42.35 | 40.75 | no | ||||

| FSLR | 146.80 | 152 | no | ||||

| ABAX | 23.86 | 25.00 | no | ||||

| CYOU | 29.05 | 32.20 | no | ||||

| PPD | 40.12 | 41.50 | no | ||||

| SVA | 8.71 | 8.00 | |||||

| MCO | 23.14 | 25.50 |