{+++}Goldman didn’t tear the cover off the ball, GOOG is up in the aftermarket but not exploding and IBM is down big. Intel by the way looks tired after it’s report and it’s only been two days. This could all change tomorrow or next week but the market looks a bit long in the tooth. DOW 10.000 has been eclipsed, we now need a close above S&P 1100 for the bulls to continue the party. The NDX needs a higher close as well to help confirm the strength in the other two indices.

I personally traded some BAC at a slight loss today, I was long, but fought the trend all day, it just wasn’t the day for the financials. My premise was for a snapback rally in GS as that would lead the group up, but that never happened. I also traded some BTU long with some good success, I also traded ACI which looks like it wants to break out, I put it as a long on the list tonight. MEE also looks good in that sector.

I marked VNO as “flat” on our chart, it was a great short and some folks made about 3,4 points, others didn’t sell any and got stopped. Please grab half profits when you get a pop, the stops are for your protection, please use your judgment on the sellside. I make my best efforts to telegraph exits on twitter, but I don’t get them all so use good common sense about taking profits.

Here are two longs to watch for tomorrow and next week. Hope you had a profitable day.

| Date | Symbol | Long Price | Short Price | Stop | Action | Result P/(L) | Triggered |

| 9-24-09 | |||||||

| MCO | 23.00 | 22.00 | Sold 1/3 sold 1/3 stopped 1/3 | +2.00

+4.30 +1.00 |

yes | ||

| MHP | 26.19 | 26 | Sold ½,stopped on balance flat | +2.00 | yes | ||

| NAV | 40.31 | 39 | Sold 1/3, Sold 1/3

Sold 1/3 |

+1.30

+3.00 +2.03 |

yes | ||

| QSFT | 16.30 | 16 | Sold ½, sold balance(10-13-9) | +.80

+1.70 |

yes | ||

| SIGA | 8.43 | 7.65 | -.80 | yes | |||

| MELA | 10.50 | 9.50 | -1.00 | yes | |||

| 9-28-09 | COCO | 17.29 | 18.25 | Sold 1/2 | +1.00 | yes | |

| ZION | 17.39 | 19.00 | Stopped ½ flat | yes | |||

| 9-30-09 | YGE | 11.90 | 12.60 | -.70 | yes | ||

| VNO | 63.00 | 65.50 | flat | yes | |||

| XCO | 19.05 | 18.00 | stopped | -1.05 | yes | ||

| MHGC | 5.60 | 5.20 | -.40 | yes | |||

| 10-1-09 | CALI | 6.35 | 5.50 | no | |||

| CENX | 8.97 | 9.60 | stopped | +.50 | yes | ||

| BAC | 16.02 | 16.80 | stopped | -.78 | yes | ||

| AAP | 37.70 | 39.40 | stopped | -1.70 | yes | ||

| 10-05-09 | EXC | 47.78 | 50 | stopped | -2..22 | yes | |

| JEF | 27.60 | 27.90 | Sold 100% (10-13-9) | +1.60 | yes | ||

| TSPT | 14.35 | 13.50 | yes | ||||

| HIG | 29.05 | 28.30 | stopped | -.75 | yes | ||

| APT | 6.25 | 6.00 | yes | ||||

| 10-7-9 | FCX | 73.43 | 73.00 | Sold half(10-13-9)

Sold balance10-14-9 |

+1.78

+3.10 |

yes | |

| 10-10-9 | PENN | 25.67 | 26.20 | yes | |||

| NITE | 23.00 | 22.40 | stopped | -.60 | yes | ||

| O | 22.85 | 24.60 | no | ||||

| STEC | 25.51 | 27.40 | Covered 1/3 | +1.00 | yes | ||

| ARST | 23.59 | 21.50 | Sold 1/3,sold 1/3 | +1.20

+2.20 |

yes | ||

| FIRE | 23.43 | 21.59 | yes | ||||

| 10-14-9 | HRBN | 19.72 | 18.90 | yes | |||

| UCTT | 6.95 | 6.30 | stopped | -.65 | yes | ||

| 10-15-09 | MS | 33.35 | 31.50 | ||||

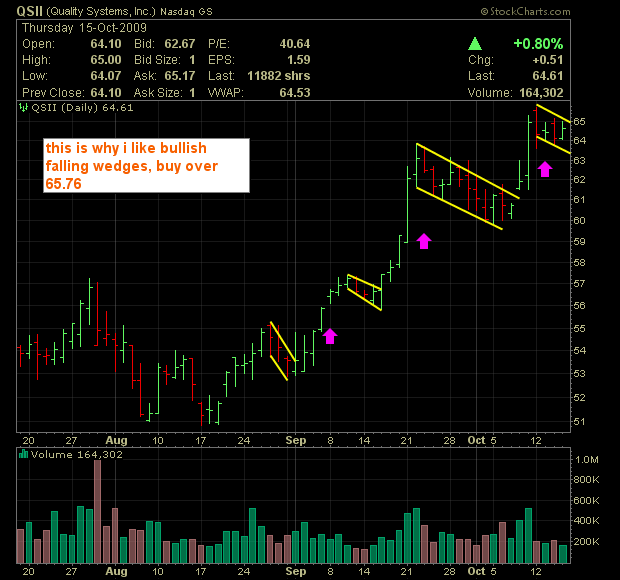

| 10-16-9 | QSII | 65.76 | 64.00 | no | |||

| ACI | 24.22 | 23.50 | no |