{+++}My perfect world scenario would be a move up to S&P 1100, maybe a bit higher, then a huge and breathtaking collapse. Opinions are like noses, everybody has one, and there are so many differing thoughts on the market right now that it can drive you mad. That’s why we need to stay light on our feet next week and be ready to press either way.

We are awash in liquidity on a global basis right now and risk appetite has returned, albeit on anemic volume. When your choices are almost zero return in other asset classes it’s easy to see why the market stair steps higher day in and day out.

I have always made my best returns at market extremes( very overbought or very oversold conditions), and I am not saying we are grossly overbought here, especially when bullish sentiment is not at an extreme, but we must be careful here. I think one ugly earnings report, coupled with a not so sunny forecast could get the ball rolling. Many argue that we are at a market high because price earnings ratios are high. I ask what earnings? None of the growth we have seen has been of the organic variety, it has been mostly due to a cease in spending and dramatic cost cutting. Analysts who “think” this move has been based on earnings are wrong as usual, I”m never surprised by these charlatans. This has been strictly a market guided higher by technicals, extreme liquidity and a collapsing greenback. It got its start with a generational spurt of short covering.

But I digress, because it doesn’t matter why the market is going up at all does it? The S&P and the e-minis closed right where there should have on Friday to give technical comfort to the bulls. That doesn’t mean it’s a ticket to higher levels, it could fail here, I just want you to be aware of all the moving parts. My gut says higher, we will know soon.

The dollar was in a tight range on Friday, actually higher at certain times during the day, yet the market still managed a nice win. There are some brilliant geniuses taking both side of that trade, mainly Rogers and Paulson, the former is very short the greenie and the later has made a substantial directional bet to the upside. Who will be right? We will probably find out sometime next year.

The banks and commercial real estate will be on my radar as usual next week, especially the financials as we are in front of earnings reports.

J.P. Morgan Chase is expected to make 49 cents a share in the third quarter, according to the averaged estimate of 19 analysts in a Thomson Reuters survey.

More than half of the $3.4 trillion in outstanding commercial real-estate debt is held by banks and vacancy rates in the apartment, retail and warehouse sectors have already exceeded levels seen in the real-estate collapse of the early 1990’s. Regional banks are particularly exposed to commercial real estate loans because they didn’t sell them through securitization as much as their larger rivals.

For the S&P 1500, which includes companies with smaller capitalizations, analysts are currently more optimistic heading into the earnings season than any other period in the last two years, said analysts at Bespoke Investment Group. It boggles my mind but please please realize the analysts are for the most part-complete idiots.

I have updated some stops and added few longs and shorts. I’ll be ready to run like a scalded monkey if this beast breaks either way. You should too. Steel stocks look iffy in here, especially U.S.Steel (X) so I will be watching the sector in the coming week. No video as my fever is bid at 102, offered at 103. Sick as hell. Let’s have a good week.

| Date | Symbol | Long Price | Short Price | Stop | Action | Result P/(L) | Triggered |

| 9-24-09 | |||||||

| MCO | 23.00 | 22.00 | Sold 1/3 sold 1/3 stopped 1/3 | +2.00

+4.30 +1.00 |

yes | ||

| MHP | 26.19 | 26 | Sold ½,stopped on balance flat | +2.00 | yes | ||

| NAV | 40.31 | 39 | Sold 1/3, Sold 1/3 | +1.30

+3.00 |

yes | ||

| QSFT | 16.30 | 16 | Sold 1/2 | +.80 | yes | ||

| SIGA | 8.43 | 7.65 | -.80 | yes | |||

| MELA | 10.50 | 9.50 | -1.00 | yes | |||

| 9-28-09 | COCO | 17.29 | 18.25 | no | |||

| ZION | 17.39 | 19.00 | yes | ||||

| 9-30-09 | YGE | 11.90 | 12.60 | -.70 | yes | ||

| VNO | 63.00 | 65.00 | yes | ||||

| XCO | 19.05 | 18.00 | stopped | -1.05 | yes | ||

| MHGC | 5.60 | 5.20 | -.40 | yes | |||

| 10-1-09 | CALI | 6.35 | 5.50 | no | |||

| CENX | 8.97 | 9.60 | stopped | +.50 | yes | ||

| 10-2-09 | X | 41.10 | 43 | stopped | -1.90 | yes | |

| BAC | 16.02 | 16.80 | stopped | -.78 | yes | ||

| AAP | 37.70 | 39.40 | yes | ||||

| 10-05-09 | EXC | 47.78 | 50 | yes | |||

| JEF | 27.60 | 27.90 | yes | ||||

| TSPT | 14.35 | 13.50 | yes | ||||

| HIG | 29.05 | 28.30 | yes | ||||

| APT | 6.25 | 6.00 | yes | ||||

| 10-7-9 | FCX | 73.43 | 73.00 | yes | |||

| 10-10-9 | PENN | 25.67 | 27.00 | no | |||

| NITE | 23.00 | 24.50 | no | ||||

| O | 22.85 | 24.60 | no | ||||

| MON | 73.85 | 76.50 | |||||

| STEC | 25.51 | 28.88 | |||||

| ARST | 23.59 | 21.50 | |||||

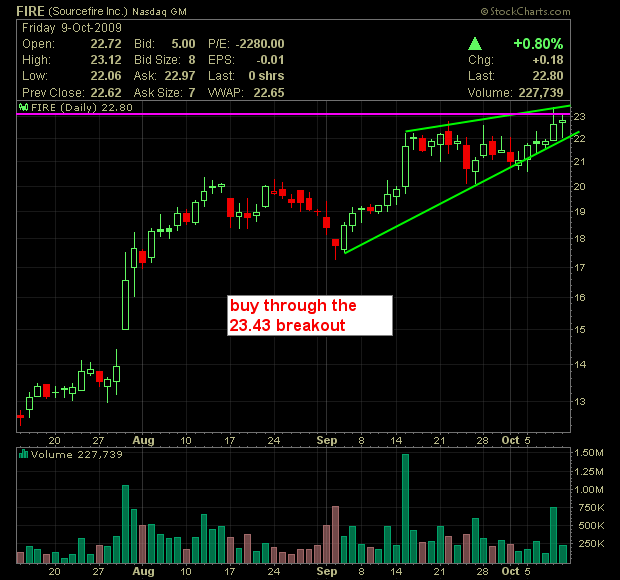

| FIRE | 23.43 | 21.59 |