{+++}I believe that this will be the most telling week we have seen in a while and I will be watching closely and communicating often with you via twitter and the blog if I have to. We could see one more burst higher as portfolio “window dressing” or performance chasing kicks into high gear.

I still think there is some room to the upside in some of the smaller biotech names like the ones listed below,as they still sport nice technical patterns. I’ve added some new longs and two new shorts that have horrible patterns.

Here are some names for the short and long side for the coming week:

LONGS (THAT HAVE TRIGGERED)

RMBS- 18.48 stop 16.80

HMIN-buy at 29.44 stop 28

ENER- BUY AT 13.50-13.60 STOP 12.70

OREX- long at 8 stop 8.25 (sold half +.80)

MELA- long at 10.50 STOP AT 9.25

EXEL- 6 STOP 6.10 ( sold half for 10%)

QSFT- 16.25 stop 16.40

CRY at $7.50 stop 8.00 (sold half +.80)

LONGS THAT HAVEN’T TRIGGERED YET:

FFIV-BUY THROUGH 39.76, STP AT BOTTOM OF FLAG AROUND 38-38.25

FOR-BUY TRIGGER 16.37 STOP 15.50

HGSI- BUY TRIGGER 20.63 STOP 19.30

JAZZ- BUY TRIGGER 10, OR 10,50 STOP 9.25

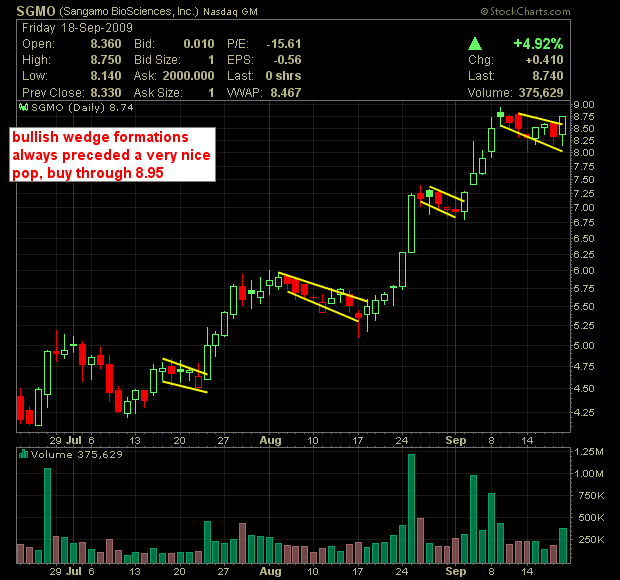

SGMO- BUY TRIGGER 8.95 STOP 8.25

OVTI- BUY TRIGGER 16.95 STOP 16.20

SHORTS THAT HAVEN’T TRIGGERED

AAP- SHORT AT 38.32 STOP 40

MCO-SHORT AT 23, STOP 25

MHP-SHORT 26.19, STOP 28

SHORTS THAT HAVE TRIGGERED

NAV- SHORT AT 40.31 STOP 42

Here is your calendar for the week.