{+++}Oil tagged $71 this morning and investors are bidding up commodities yet again. Yesterday, The Dow Jones fell 1 point, the S&P 500 rose 3 points, while the tech-heavy Nasdaq rose 18 points after an improved profit forecast from chipmaker Texas Instruments. Government data on weekly energy inventories are due at 10:30 a.m. Eastern, on the heels of the American Petroleum Institute’s own update indicating a larger-than-expected drawdown of crude stockpiles.

In the U.S., the Fed’s key Beige Book of evidence on the economy is due for release at 2 p.m. Eastern. The last time it came out, the Beige Book said “overall economic activity contracted further or remained weak”.

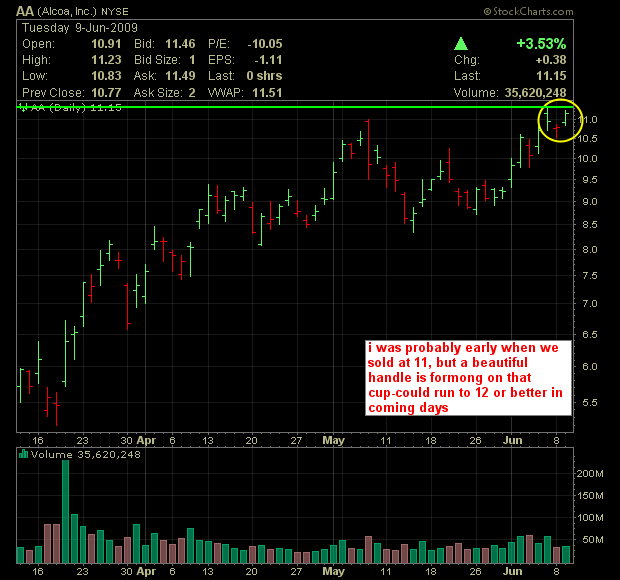

Hey guys, as you know we had a very nice trade on AA last week, I was examining the chart last night and it is flashing a buy signal at $11.33 for a possible move to the 12 area. I may have been a little early on the sale but we still nailed 10-13% in a couple of days. Materials will probably gap up so don’t get caught chasing a gap but I would feel good re-entering.

If I see anything that warrants your attention I will do a blog post later.