{+++}  The dollar has been showing extreme weakness of late and has been hitting lows against other currencies and is at a five month low. Funny what happens when you print loot on a daily basis. We aren’t at the point of 1923 Germany when kids literally played in the streets with the German mark as it fell to 4.3 trillion marks to the dollar.

The dollar has been showing extreme weakness of late and has been hitting lows against other currencies and is at a five month low. Funny what happens when you print loot on a daily basis. We aren’t at the point of 1923 Germany when kids literally played in the streets with the German mark as it fell to 4.3 trillion marks to the dollar.

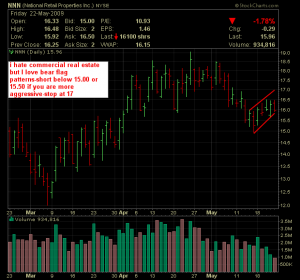

Equities spent the first half of the week on an even keel, making solid gains as investors took heart from positive quarterly results out of home improvement retailers Lowe’s and Home Depot and reports that several leading banks would be allowed to repay TARP funds soon. In another milestone on the road to healthier markets, the VIX volatility index dropped below 30 on Tuesday for the first time since Lehman’s failure, while the DJIA had risen nearly 450 points to a weekly high around 8590 by Wednesday morning. However Q1 National Association of Realtors report that forecasted commercial real estate activity would remain weak for six to nine months and the release of the April 29th FOMC minutes helped slam on the breaks. The FOMC minutes forecasted a deeper recession in 2009 and a slower rebound in 2010, and revealed that the Fed is open to expanded quantitative easing, reminding market participants about the precarious state of the economy and ballooning US government debt. Then on Thursday afternoon S&P cut its outlook on the UK’s AAA sovereign rating to negative from stable, a move that cast a shadow on the AAA ratings of the United States. This led to renewed weakness in the greenback against other major currencies, which in turn helped keep crude futures above $60/barrel. For the week, the S&P 500 rose 0.4%, while the DJIA and the Nasdaq Composite each gained 0.7%.

Thursday was a pivotal day for overall sentiment in US Treasury markets, as the safe haven status of US government paper appeared to be seriously questioned. After S&P downgraded the UK, treasuries and the USD sold off sharply in tandem with equities, in contrast to the inverse relationship that has been en vogue since the collapse of Lehman in September. TBT (short treasury price) traded higher and TLT (long treasury price) traded lower. The question remains whether the weakness in US Treasury markets is really signaling a pivotal change in investor demand or whether it is just technically driven trade in a thin holiday market ahead of the first new supply in weeks.

The credit card reform bill and its contentious “Bill of Rights” passed Congress and was signed by the president. The legislation puts a variety of new restraints on interest rates charged for consumer credit, which are seen as good for consumers and bad for lenders. In a related story, JP Morgan shifted a portion of its debt card users to Visa from MasterCard, affecting more than half of MA’s $59B portfolio of debit card users. A MasterCard spokesperson insisted the move would not have any material impact on revenue. We are short AXP so let’s hope some of this dreary news will put some pressure on the name in the coming days and weeks. Regardless of what the Mastercard spokesman said, the stock is starting to look like a short as a negative bear flag is forming on the daily chart.

Gold hasn’t ignored this dynamic and is forming a bullish cup on the daily chart shown below. I posted a chart on DGP the double long ETF for gold on Thursday, you should keep both on your radar. GLD looks like a long over about $94.80.

Unfortunately we were stopped on MON this week, the stock traded up about a buck and half after it triggered and then failed. AXP triggered short at 23.50, but did it on a Friday before a three day weekend when volume was light. Hopefully it can follow through a little more to the downside, the stop is 25-25.50 depending on your risk tolerance. Here is the post from the other day where I updated the other stops. CRM gapped down and I recommended that you cover the entire position on twitter for a gain of about $3.5-4 points.

My heart of hearts is telling me to be more short but I won’t get too aggressive until I see some more follow through to the downside. I had a phenomenal year last year being short the market so if things start to get ugly again I feel confident that we will be in a very enviable position compared 90% of the crowd. We are at such an advantage in this market to have a short term view on things, I take profits quickly and in the coming weeks may take them even faster from the long side. As I’ve said before, I trust this market about as much as I trust Michael Jackson with my kids at a play date.

Energy has had quite a run of late and it’s not because of organic demand or an improvement in the global economy, I’m sure it’s mainly due to the plunge in the dollar. The CRB reported Thursday that speculators are starting to run wild in the street again. That dynamic can change fast and below I have a couple of shorts to watch in the energy patch. One of them, SLB, was a long for us only a couple of weeks ago and we grabbed about 5-6 points pretty quick.

Here are some names to put on your radar for the coming week and here is the data calendar. Honor my triggers and stops.