Two up days in a row too much to ask? Evidently, when there is not one piece of good news on God’s green earth to make a rally last for more than an hour. Feb. 5 and 6 are still the last two consecutive up days and I’m starting too think I may create a prop bet in Vegas-if it’s still open.

Two up days in a row too much to ask? Evidently, when there is not one piece of good news on God’s green earth to make a rally last for more than an hour. Feb. 5 and 6 are still the last two consecutive up days and I’m starting too think I may create a prop bet in Vegas-if it’s still open.

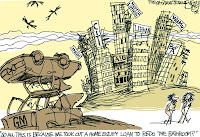

My “state of crash” theory is still in motion as things just meander aimlessly to the down side and it does feel like death by a thousand cuts. My current theory is that we could see more market pressure as we get closer to the “stress test” results. Any longs in the market will want to take chips off the table as the possibility of a bad result strongly exists. Uncertainty is a killer and these results will carry much weight. If it is worse than people think, it could open the door for full blown nationalization for more than just C and BAC but for WFC, USB and others. XLF would implode further and it would take the market with it. Just a theory, but I will be watching closely. As far as the meeting on the Hill about mark to market accounting, I have zero confidence that anything will be resolved on that front either, too little too late. Uptick rule? Bring it, the market still collapsed when we couldn’t short stocks at all.

I’m still waiting for the rally that will last for more than 90 minutes.