I’m the biggest money grubbing capitalist that you will ever find, but when I trade these markets on a daily basis and continue to get suffocated with the same rhetoric and rudderless leadership from both sides of the political aisle, I say let’s just do it. Nationalize the garbage banks with garbage assets and let the market get on with acting like a market gain. The powers that be feel that nationalization would send a message that we are in trouble? Newsflash to the sevants on K Street, the dam is breaking, and all your collective thumbs in the wall have done absolutely nothing so far. If they don’t do it soon it will be another case of “too little too late.”

I’m the biggest money grubbing capitalist that you will ever find, but when I trade these markets on a daily basis and continue to get suffocated with the same rhetoric and rudderless leadership from both sides of the political aisle, I say let’s just do it. Nationalize the garbage banks with garbage assets and let the market get on with acting like a market gain. The powers that be feel that nationalization would send a message that we are in trouble? Newsflash to the sevants on K Street, the dam is breaking, and all your collective thumbs in the wall have done absolutely nothing so far. If they don’t do it soon it will be another case of “too little too late.”

Nouriel Roubini has this to say in the Washington Post this morning:

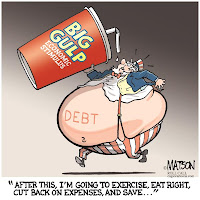

As free-market economists teaching at a business school in the heart of the world’s financial capital, we feel downright blasphemous proposing an all-out government takeover of the banking system. But the U.S. financial system has reached such a dangerous tipping point that little choice remains. And while Treasury Secretary Timothy Geithner’s recent plan to save it has many of the right elements, it’s basically too late.

The subprime mortgage mess alone does not force our hand; the $1.2 trillion it involves is just the beginning of the problem. Another $7 trillion — including commercial real estate loans, consumer credit-card debt and high-yield bonds and leveraged loans — is at risk of losing much of its value. Then there are trillions more in high-grade corporate bonds and loans and jumbo prime mortgages, whose worth will also drop precipitously as the recession deepens and more firms and households default on their loans and mortgages.

Last year we predicted that losses by U.S. financial institutions would hit $1 trillion and possibly go as high as $2 trillion. We were accused of exaggerating. But since then, write-downs by U.S. banks have passed the $1 trillion mark, and now institutions such as the International Monetary Fund and Goldman Sachs predict losses of more than $2 trillion.

Nationalization is the only option that would permit us to solve the problem of toxic assets in an orderly fashion and allow lending finally to resume. Of course, the economy would still stink, but the death spiral we are in would stop.

Here is the fully story.