It was a volatile day in the markets and the indices ended up in the face of abundant layoffs. The announcement of roughly 50,000 job cuts today, mostly from U.S. companies, was the largest since the year started. America Express announced a 79% tumble in earnings and said cardholder activity dropped 10%, they also said the future looks a little rough. The stock moved up 3% in after hours trading, so I guess if you don’t announce the need for more TARP funds or avoid a dividend elimination, your stock price catches a rally.

It was a volatile day in the markets and the indices ended up in the face of abundant layoffs. The announcement of roughly 50,000 job cuts today, mostly from U.S. companies, was the largest since the year started. America Express announced a 79% tumble in earnings and said cardholder activity dropped 10%, they also said the future looks a little rough. The stock moved up 3% in after hours trading, so I guess if you don’t announce the need for more TARP funds or avoid a dividend elimination, your stock price catches a rally.

Goldman Sachs came out negative on the banks today and cut USB to a “conviction sell” ( that’s the rating they use when they only “think” they’re going to be dead wrong) and went to a neutral on BAC, but went to a ” conviction buy” on JPM. Personally I’ve had my own conviction sell on them all for over a year and yes, I do reiterate my sell.

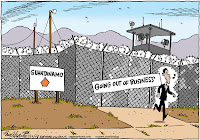

I’ve been struggling to find a cure for this economic crisis for over a year, but it looks like it may have been solved today by this Rhodes Scholar.

I had gold and energy on as trades this morning and they performed fairly well, but I now believe oil is ready for a possible pullback so I’m off that trade for now. TBT acted very well and I still like the trade.

I will be back later with some ideas for tomorrow