“There is a time to go long. There is a time to go short. And there is time to go fishing.”–Jesse Livermore

Not sure if its time to go fishing or not, but the tape took a little rest last week and finding setups got a bit harder. Some stocks look extended and heavy, others didn’t care and just go higher. Many stocks that were priced to perfection got hit. Bio names like $SRPT and $VRTX got blasted (SRPT more). Stocks like $SWI got throttled 11 points from Thursday’s top to Friday’s bottom. The market will reward a stock when it does what it is supposed to do, but it will decimate a stock if it doesn’t live up to expectations. You have to be perfect or you go to the wood chipper. Welcome to the stock market.

If you look at the $SPX on Thursday and Friday you will see weakness, but that weakness got bought on both days, and both days it went ahead and closed at the highs. That’s bullish action. Dips getting bought. 1699-1700 is the nut that needs to cracked for this bull to go higher.

There was some Capitol Hill drama about who the next Fed president will be. The stock market is yellin’ for Yellen, but Larry Summers seems to hold the lead so far. Summers is more of a hawk and Yellen would be the second coming of Bernanke. This drama will get interesting and will effect stocks along the way. I still think the market tags 1780-1800 this year.

We could see some lifeless chop out of this tape, as we find ourselves in the middle of the summer doldrums. So far the market has managed to get through earnings season with out a big hitch, that in itself is a positive. The major names have reported, but there are still many stocks on the runway waiting to report.

Here are some set ups to put on your radar for next week. You can come by for a free trial here.

$LGF – I like this setup and this light volume successful pullback its 20 day moving average. The 33 level may break this one out again.

$IMMU– a buyable pullback here. It’s a biotech so wear Kevlar.

$KERX is finally under accumulation again and made a move on Friday. FDA news in August or September. Can get to 12. May want to make a run at the January high soon.

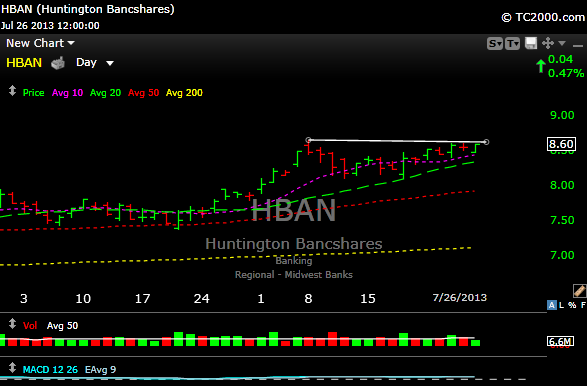

$HBAN The smaller regional banks are consolidating and still look higher. ($KEY) looks the same.

$DNKN My fave coffee, but put in a high volume reversal on Friday and took back its 20 day moving average.. It think this one work higher.

$TTHI Great news last week on some fast track approval , then followed by a licensing agreement with $LLY. Chart is a bit sloppy, but I see 5-5.50 short term. Have your stop around the 3.95 level.

$AAPL Over 445 probably gets you higher. Possible targets 455-465. The 200 day moving average is up at the 480 level. Hey, why not? I would not play it until it closes or looks like its going to close 445. Waiting for cornea display and two tone iPods.

Subscriptions here